Draft 2024 Integrated Services Plan

The Australian Pipelines and Gas Association (APGA) represents the owners, operators, designers, constructors and service providers of Australia’s pipeline infrastructure, connecting natural and renewable gas production to demand centres in cities and other locations across Australia. Offering a wide range of services to gas users, retailers and producers, APGA members ensure the safe and reliable delivery of 28 per cent of the end-use energy consumed in Australia and are at the forefront of Australia’s renewable gas industry, helping achieve net-zero as quickly and affordably as possible.

APGA welcomes the opportunity to contribute to the Australian Energy Market Operator (AEMO)’s consultation on the Draft 2024 Integrated Systems Plan (the ISP). As the ISP will set the foundations for energy investment in Australia across the next few critical decades of transition, it is important that we get this right.

APGA supports a net zero emission future for Australia by 2050[1]. Renewable gases represent a real, technically viable approach to lowest-cost energy decarbonisation in Australia. As set out in Gas Vision 2050[2], APGA sees renewable gases such as hydrogen and biomethane playing a critical role in decarbonising gas use for both wholesale and retail customers. APGA is the largest industry contributor to the Future Fuels CRC[3], which has over 80 research projects dedicated to leveraging the value of Australia’s gas infrastructure to deliver decarbonised energy to homes, businesses, and industry throughout Australia.

Reaching net zero cannot realistically be achieved without the contribution of gas power generation (GPG). From ensuring grid stability and resilience, to providing backstop generation in times of energy drought, to accelerating the retirement of coal powered generation, ongoing investment in GPG is critical and necessary.

Critical investment in gas powered generation and capacity may not be made without policy support.

APGA’s submission identifies three key policy changes which would support ongoing investment in GPG:

- Providing incentives for investment, such as including GPG in the capacity investment scheme.

- Consider the contribution of existing and future gas storage to avoid overinvestment in energy storage and electricity transmission infrastructure.

- Model the whole energy market through investing in multi-vector energy modelling.

ISP highlights critical need for policy support of gas power generation

The Draft 2024 ISP recognises the critical importance of gas in reaching net zero. The Draft ISP forecasts that by 2050, the National Energy Market (NEM) will need a total of 16.2 GW of flexible GPG, with 8 GW existing capacity needing to be replaced and 5 GW added. This is an increase of 10 GW from the 2022 ISP.

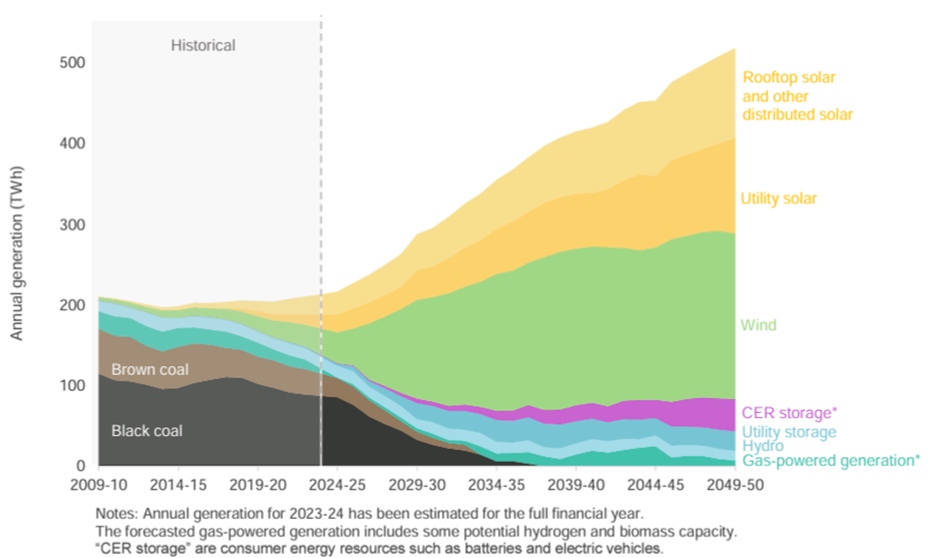

The Draft ISP (Figure 1) demonstrates an expectation that GPG will continue to provide a critical backstop function until approximately 2033. GPG is then required at a much greater capacity as brown and black coal generation ceases.

Figure 1: Forecast generation mix in the NEM

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

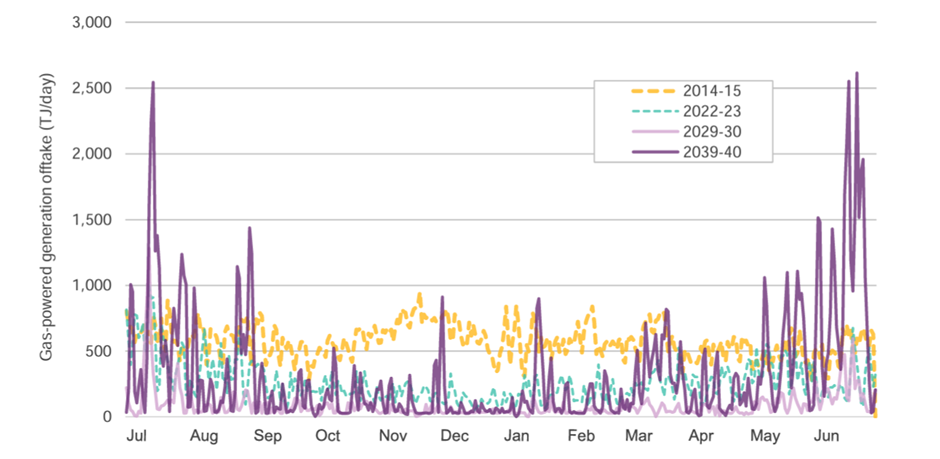

The Draft ISP also demonstrates (Figure 2) the nature of expected change in role of GPG from ‘mid-merit’ to critical backstop. Projected winter demand peaks for GPG grow drastically in 2039-40. It is worth noting that this projected offtake is well in excess of current generation capacity.

Figure 2. Forecast gas-powered generation offtake in the NEM

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

Although GPG will provide a critical contribution to the NEM over the next decade,[4] the nature of peaking plants can make them unattractive for private investment. Because the plants are only dispatched a few times a year, it can be challenging to recover the investment and fixed costs of power generation.

The uncertainty of gas supply and demand volumes – exacerbated by poor demand forecasting – and additional costs imposed by emissions reduction policies introduces additional investment risk. For these reasons, it may be difficult to maintain investment in existing GPG or bring GPG projects to Final Investment Decision in the market in the absence of government mechanisms or incentives.

In the absence of incentives, existing GPG may be reluctant to remain in the market and new investments in GPG may not be sufficient to develop the capacity required from 2033. If GPG is to meet the projections in the ISP, the Australian Government must investigate long-term availability or capacity payments to provide sufficient incentive for GPG to remain in the market and to promote long-term investment.

APGA echoes its recommendation previously made in its 2024-25 Federal Budget submission:[5] the Australian Government should include gas power generation in the capacity investment scheme or consider a scheme that provides the long-term investment signals necessary to support investment in gas power generation.

Exclusion of gas storage risks over investment in long-term storage

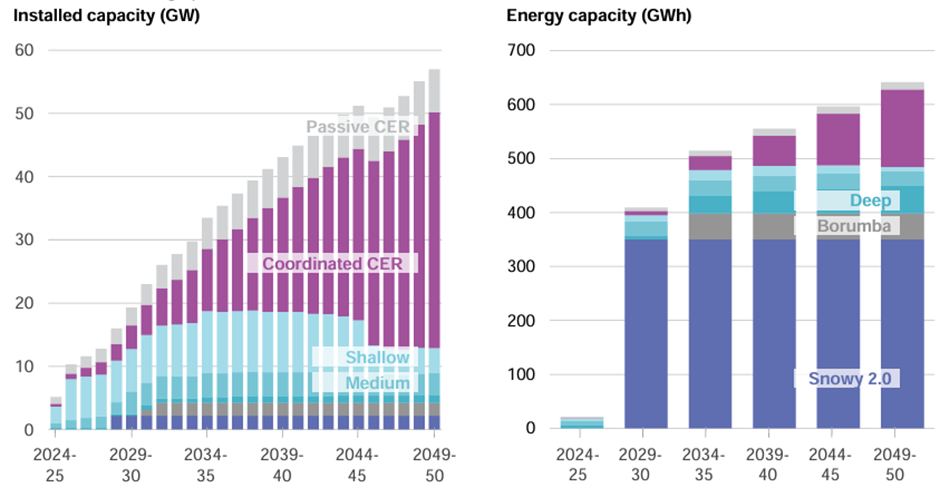

The Draft 2024 ISP indicates the need for substantia; energy storage uplift. The ISP projects the NEM will need 514 GWh of storage capacity in 2034-35, increasing to 642 GWh in 2049-50. In terms of installed capacity, much of this demand is expected to be met by passive and coordinated consumer energy resources (CER), but it is the shallow, medium and deep grid-connected storage which will be key to maintaining energy system reliability.

The Draft ISP details expected installed capacity and energy storage capacity to 2050 (Figure 3). These figures are conspicuous for what is missing: current gas storage capacity.

Figure 3. Forecast storage installed capacity and energy storage capacity in the NEM

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

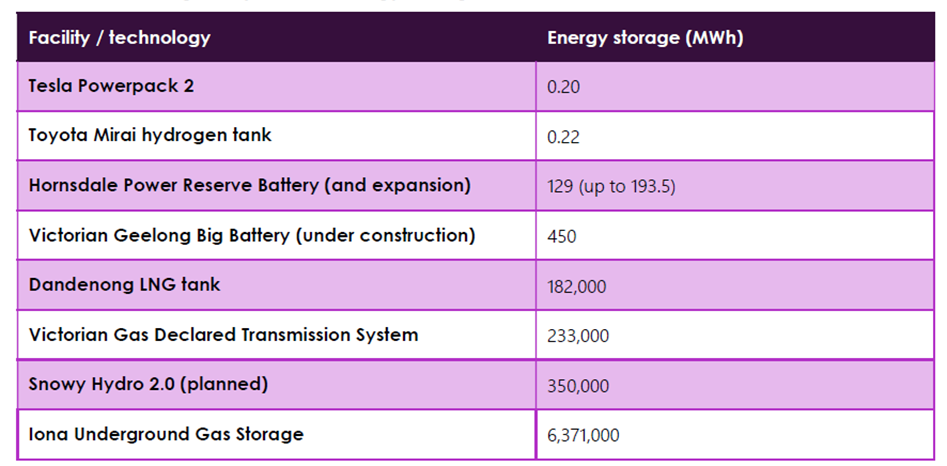

AEMO identified this scale of gas storage capacity in its submission to the Victorian Gas Substitution Roadmap consultation in 2021 (Figure 4).[6] As seen in Table 1 from its submission below, AEMO identifies that the Iona Underground Gas Storage facility, just one of several underground storage facilities available in the east coast gas market, has an energy storage capacity of 6,371 GWh. When used in gas power generation, energy stored in Iona can provide over 2,100 GWh of electricity from this deep, long-term form of energy storage.

Figure 4. Existing and planned energy storage

Source: AEMO, 2023, Victoria’s Gas Substitution Roadmap.

Iona’s 2,100 GWh is over three days’ worth of total NEM demand and three times the storage need identified in the ISP. In not considering gas storage accessed through GPG, the ISP risks substantial overinvestment in energy storage and transmission infrastructure.

Today, Iona acts as deep storage to cover the peak winter period, which is replenished during the lower demand summer period. Iona’s 6,371 GWh storage capacity can be compared to the Snowy 2.0 PHES project which has an expected storage capacity of 350 GWh.

The Victorian Declared Transmission System – the gas pipelines which connect Iona to Victorian gas customers – includes a similar scale of energy storage capacity to Snowy 2.0 with 233 GWh of linepack storage in and of itself. These figures start to multiply as we expand the horizon to consider other underground gas storage and gas infrastructure around the NEM.

APGA recommends that the draft ISP consider the contribution of current and future gas and renewable gas storage and transmission to contribute to the NEM’s energy storage and decarbonisation needs.

AEMO needs Federal support to deliver an energy model for the future

APGA has been transparent in advising AEMO that its existing models are not able to accurately represent the gas market. As the ISP and other modelling documents produced by AEMO are increasingly used to represent the energy system as a whole, not just the electricity system, the discrepancies in modelling are becoming increasingly important to address.

AEMO’s gas forecasts have consistently underestimated gas power generation consumption, and has not accurately modelled gas use transition.[7] This has real consequences, where gas customers, relying on forecasting, do not contract the supply of gas necessary to meet demand before they actually need it. The ISP in turn fails to model least-regrets investments. This has made AEMO’s projections unreliable for gas market operators.

As these projection discrepancies can be significant, operators must leave their options open, which comes at a cost that is ultimately borne by customers. If operators acted on projections from the 2020 Draft ISP, current GPG capacity would be short if not insufficient.

ISP modelling also does not consider the realities of hydrogen production supply chains, including bulk energy production behind the meter, and transport through hydrogen pipelines. This may have a dampening effect on the industry by building in higher cost.[8]

These concerns and suggested solutions to modelling inaccuracies have been detailed in APGA’s submission to the Integrated Systems Plan Directions Paper,[9] and in our submission to the 2024-25 Federal Budget.

Modelling outcomes could be improved by expanding to a model which electricity and gas customers and production are considered on equal footing, at equal or higher resolution than current modelling. It is APGA’s understanding that AEMO has concerns about the viability of this, largely around resourcing and maintaining the robustness of its existing electricity models. However, examples of two possible approaches already exist and can provide a model way forward.

APGA recommends AEMO commission multi-vector energy modelling. This would complement the existing electricity model, considering future gas supply and network economics with the introduction of renewable gases at a minimum.

This model could be developed in one of two ways:

- Separate interacting single-vector models

ACIL Allen have designed a concept which has been used to model the impacts of a renewable gas target on Australian gas customers and the economy (GDP). This will be the subject of a study released by APGA in due course. - A single multi-vector model

The University of Melbourne has designed a concept as part of a Future Fuels CRC project considering optimisation across integrated gas and electricity systems considering electrolyser and gas power generation technologies. For more information, please visit the Future Fuels CRC website.

To discuss any of the above feedback further, please contact me on +61 422 057 856 or jmccollum@apga.org.au.

Yours sincerely,

JORDAN MCCOLLUM

National Policy Manager

Australian Pipelines and Gas Association

[1] APGA, Climate Statement, available at: https://www.apga.org.au/apga-climate-statement

[2] APGA, 2020, Gas Vision 2050, https://www.energynetworks.com.au/resources/reports/2020-reports-and-publications/gas-vision-2050-delivering-a-clean-energy-future/

[3] Future Fuels CRC: https://www.futurefuelscrc.com/

[4] In the Draft ISP, AEMO notes that GPG will change its role from ‘mid-merit’ generation to that of a critical backstop: ‘Gas generation can provide back-up supply during long periods of ‘dark and still’ renewable droughts, particularly in the winter, and rare times of extreme peak demand.’

[5] APGA, 2024, Submission: 2024-25 Federal Budget, https://39713956.fs1.hubspotusercontent-na1.net/hubfs/39713956/240125%20APGA%202024-25%20Pre-Budget%20Submission.pdf

[6] AEMO, 2021, Victoria’s Gas Substitution Roadmap, https://engage.vic.gov.au/download/document/17466

[7] Frontier Economics, 2021, The role of gas in the transition to net-zero power generation, https://www.apga.org.au/sites/default/files/uploaded-content/field_f_content_file/frontier-economics-report-stc.pdf

[8] APGA, 2023, Submission: Draft Inputs, Assumptions and Scenarios Report, https://apga.org.au/submissions/draft-2023-inputs-assumptions-and-scenarios-report

[9] APGA, 2023, Submission: Integrated Systems Plan Review – Directions Paper, https://apga.org.au/submissions/integrated-system-plan-review-directions-paper