ELECTRICITY AND ENERGY SECTOR PLAN

Executive Summary

The Electricity and Energy Sector Plan (EESP) Discussion Paper is clear in its framing – Australia needs alternative low carbon fuels to achieve its emission reduction goals. Alternative low carbon fuels such as renewable gases and renewable liquid fuels are a critical part of the renewable energy ecosystem. Policy support for these new forms of renewable energy has been insufficient across the past decade and this must be addressed as a matter of urgency if Australia is to meet its climate ambition.

The Australian Pipelines and Gas Association (APGA) supports the intent of the EESP to explore policy support for alternative low carbon fuels. Decarbonising existing fuel supply ensures all energy customers can decarbonise and is key to a future made in Australia. Gas power generation (GPG) will also play a vital role in firming renewable generation on the pathway net zero electricity supply.

When considering policy support, the Federal Government can learn from the policies which have worked to enable electricity decarbonisation. Certification and NGER recognition, target setting and contract for difference schemes have driven the energy transition to date and provide an excellent basis for its acceleration through gas and liquid fuels and GPG support.

Decarbonising gas and liquid fuel supply

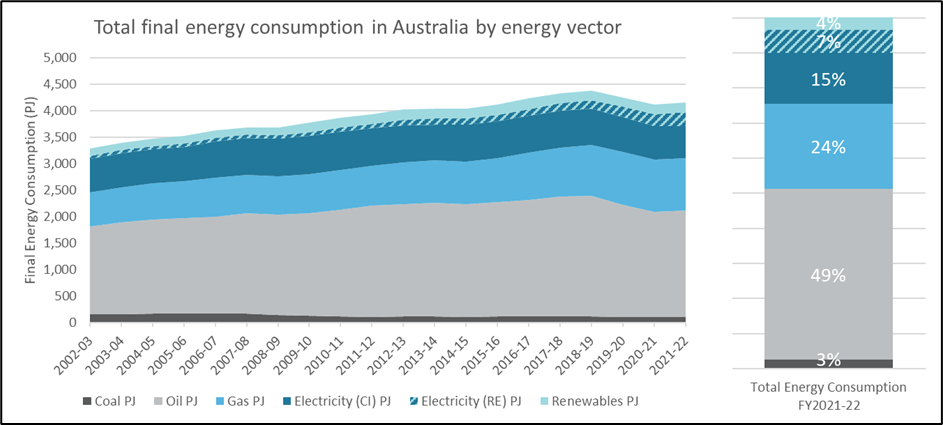

Decarbonising gas and liquid fuels is critical for the economy. Gas accounts for 24% of all end-use energy consumption in Australia and is a critical input to Australian industry, mining and manufacturing.

Low-cost gas transport and storage infrastructure and low-cost gas appliances are part of the reason customers choose natural gas today. These low-cost advantages are also available to the renewable gas supply chain as it develops:

- Existing gas infrastructure costs less than electricity infrastructure, can deliver biomethane today, and can deliver 100% hydrogen with minimal additional cost[1].

- New renewable gas transport and storage infrastructure cost less than new electricity transport infrastructure and mature electricity storage options1.

- Biomethane and hydrogen appliances cost less than their electric equivalents1.

Some gas customers will have no option other than to decarbonise via renewable gas. Economic analysis by ACIL Allen indicates a minimum of 210PJpa of renewable gas is required to decarbonise industrial gas customers alone. More than this will be required to enable future expansion of Australian manufacturing and the production of green export products.

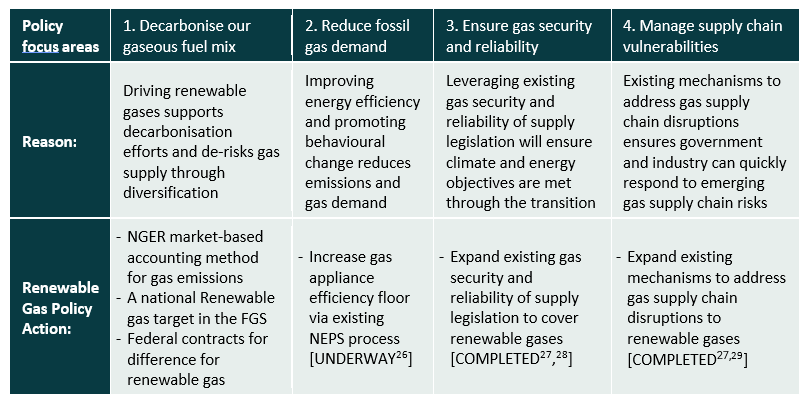

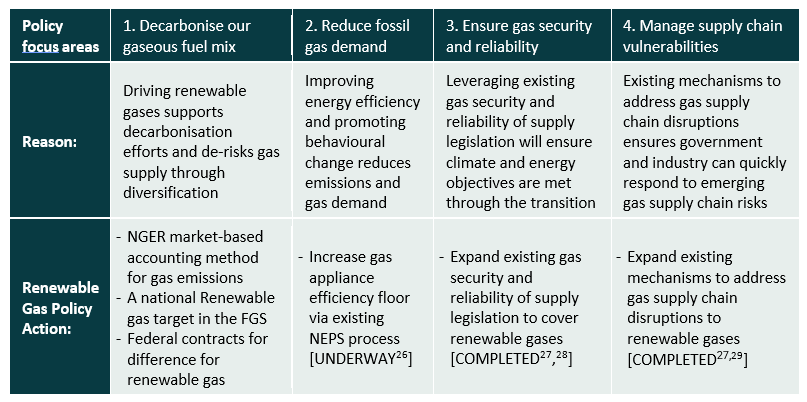

The policy focus areas identified for liquid fuels in Section 4.7 of the consultation paper can also be applied to decarbonising gas supply. The table below maps these policy focus areas to the gas supply chain. Consideration of renewable gas policy opportunities within this framework shows that in some regards, policy change to enable renewable gases is already underway. However, further policy support to decarbonise our gaseous fuel mix is required.

Table E1. Renewable gas policy focus areas and associated policy actions

Gas enables net zero electricity in Australia

Today’s gas supply chain helps keep electricity prices low and reliability and security high. It does so by fuelling GPG and taking much of Australia’s seasonally variable energy load off the electricity grid – most of Australia’s winter heating is powered by gas. Gas can continue to support electricity reliability and security as both energy systems decarbonise together. However, policy support is required.

The Draft 2024 ISP clearly sets out the role of GPG in a decarbonised National Electricity Market:

As Australia’s coal-fired generators retire after decades of service, renewable energy connected with transmission, firmed with storage and backed up by gas-powered generation (GPG) is the lowest cost way to supply electricity to homes and businesses.[3]

Despite this, GPG is excluded from the Capacity Investment Scheme (CIS). This impedes the investment in GPG needed to secure the lowest cost pathway to 82% renewable electricity supply according to AEMO.

GPG support aside, policy support to enable renewable gas supply will support a decarbonising gas system, in turn reducing the load on a future net zero NEM.

Policy recommendations

APGA recommends the Department undertake modelling on the least cost pathway to gas use decarbonisation in Australia to inform renewable gas policy. Based upon industry analysis and AEMO recommendations relating to GPG, APGA proposes four policy recommendations across the immediate and medium term.

Immediate term policy recommendations

Policy action APGA recommends the EESP identifies for immediate action:

NGER market-based method for gas emissions accounting

GreenPower renewable gas certificates are being issued today, but NGER does not recognise these. Recognising GreenPower and future renewable gas certificates in NGER emissions accounting is critical to unlocking tens of petajoules of renewable gas production projects reaching FID in the near term.

GPG support via the CIS or analogous support mechanism

Extend the CIS to include GPG or develop a similar scheme to provide the long-term investment signals necessary to support investment in GPG capacity.

Medium term policy recommendations

Policy action APGA recommends the EESP identifies for medium term action:

A national Renewable Gas Target

Targeting the least cost pathway to net zero gas sets national gas decarbonisation ambition and strong industrial reliance on renewable gas makes a national RGT no-regrets policy.

Contracts for Difference for renewable gas supply

Renewable gas certification and recognition in NGER is the first step in starting a renewable gas industry today. The Hydrogen Headstart program is an excellent start but more must be done to ensure availability of large volumes of renewable gas including biomethane. Renewable gas Contract for Difference schemes could be used to ensure the cost of biomethane does not exceed the cost of natural gas for consumers today.

About

The Australian Pipelines and Gas Association (APGA) represents the owners, operators, designers, constructors and service providers of Australia’s pipeline infrastructure, connecting natural and renewable gas production to demand centres in cities and other locations across Australia. Offering a wide range of services to gas users, retailers and producers, APGA members ensure the safe and reliable delivery of 28 per cent of the end-use energy consumed in Australia and are at the forefront of Australia’s renewable gas industry, helping achieve net-zero as quickly and affordably as possible.

APGA supports a net zero emission future for Australia by 2050[4]. Renewable gases represent a real, technically viable approach to lowest-cost energy decarbonisation in Australia. As set out in Gas Vision 2050[5], APGA sees renewable gases such as hydrogen and biomethane playing a critical role in decarbonising gas use for both wholesale and retail customers. APGA is the largest industry contributor to the Future Fuels CRC[6], which has over 80 research projects dedicated to leveraging the value of Australia’s gas infrastructure to deliver decarbonised energy to homes, businesses, and industry throughout Australia.

1 Decarbonising gas and liquid fuel supply

The EESP Discussion Paper takes Australia forward in its energy decarbonisation journey by committing an entire section to alternative low carbon fuels. Doing so highlights the need to decarbonise gas and liquid fuel supply chains. While both energy types are on their own decarbonisation journeys, similarities between the two mean that learnings from the decarbonisation of one can inform how best to decarbonise the other.

Over 75% of Australia’s energy demand is consumed directly as fossil fuels[7] (Figure 1). Many of these direct fuel consuming energy customers are unable to electrify their energy demand – and a majority of these are the industrial energy customers upon which the Australian economy relies[8]. Gas and liquid fuel supply have renewable alternatives that must be deployed to achieve net zero:

- Natural gas has renewable gas alternatives such as biomethane and hydrogen.

- Liquid fuels have renewable liquid fuel alternatives such as bioethanol and renewable diesel.

Figure 1: Total final energy consumption in Australia by energy vector[9]

Accelerating the decarbonisation of existing gas and liquid fuel energy supply chains via alternative low carbon fuels will ensure these energy customers remain part of the Australian economy. They can continue to mine our resources, process our materials, make our products, and provide the jobs and economic activity that keeps the Australian economy vibrant and successful. Section 1.1 shows that the ability to use the lower cost infrastructure and appliances to transport, store and use fuels can help reduce the cost of an otherwise electricity – only energy transition.

Robust renewable fuels supply chains support a more secure and reliable energy system in a net zero future[10]. This makes renewable fuels essential to underpinning a future made in Australia. Secure and reliable carbon neutral energy of all forms will be required to re-align Australia’s economy towards carbon neutral advanced manufacturing. Without a competitive supply of renewable fuels, Australia risks significant carbon leakage as industry chooses to relocate rather than decarbonise.

Beyond achieving net zero for today’s gas customers, putting gas supply on its own decarbonisation journey also enables broader decarbonisation in the immediate term. Once gas is on a pathway to net zero, existing coal and liquid fuel customers can achieve immediate short-term emission reductions by transitioning to natural gas today, knowing natural gas will transition to renewable gas tomorrow.

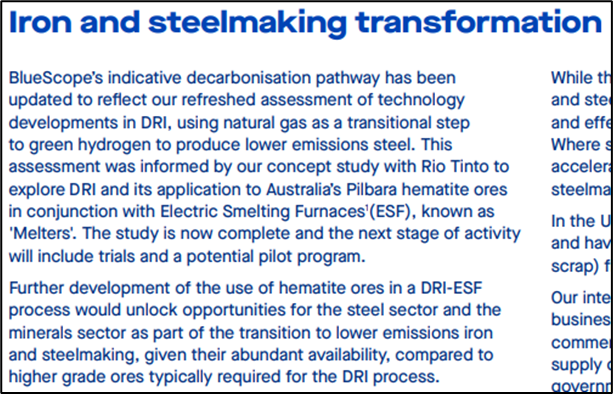

This makes coal and liquid fuel emissions reduction cheaper and easier in the near term, accelerating decarbonisation in the decade to 2035. An example of this can be seen in BlueScope, Rio Tinto and BHP pursuing Direct Reduced Iron (DRI) technologies to replace coal supply in the short term with natural gas, and in the long term with hydrogen[11] (Figure 2). BHP is also transitioning from diesel to gas powered generation to firm variable renewable generation[12]. The opportunity to more rapidly decarbonise beyond today’s gas customers makes renewable gases a priority within the EESP.

Figure 2: Excerpt from BlueScope 2023 Sustainability Report

1.1 The advantage of gas supply chains

All natural and renewable gas supply chains benefit from the advantages of gas infrastructure and appliances. The simple, flexible nature of pipeline infrastructure makes it a cost-effective way to not only transport energy, but store energy within transmission infrastructure. As a result, natural gas remains lower cost for customers to use today in comparison with other options – even when piped thousands of kilometres across the country.

Similarly, appliances that use natural or renewable gases are cheaper than their alternatives. This lower upfront cost can make up for their energy efficiency which is inherently lower than heat pumps. Higher energy consumption through lower cost appliances can lead to lower cost of energy and appliances combined[13].

These advantages means that renewable gases can not only serve those gas customers with no other decarbonisation choice, but they can do so at a cost competitive with renewable electricity13. To understand the cost of decarbonisation for energy customers through alternative low carbon fuels, it is necessary to consider the cost effectiveness of energy transport, storage and appliances alongside the cost effectiveness of energy production.

1.1.1 Existing gas infrastructure

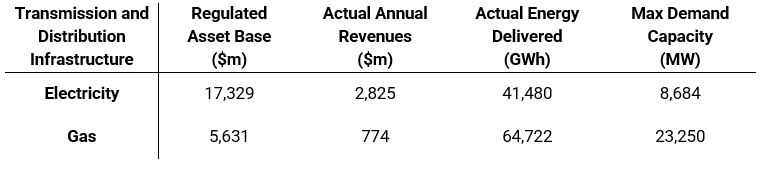

Direct comparison of like-for-like gas and electricity infrastructure demonstrates that gas infrastructure consistently costs less when providing equal or higher supply capacity. This is why gas infrastructure draws lower revenues from customers.

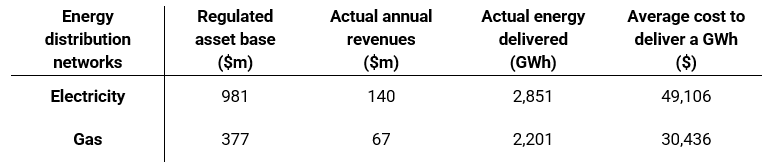

Table 1 and Table 2 below demonstrate comparisons of the regulated asset bases (RABs) of comparable gas and electricity infrastructure in Victoria and the ACT.

Table 1: Costs and deliveries of Victoria’s energy infrastructure[14]

Table 2: Relative cost of energy delivery for gas and electricity distribution in the ACT[15]

In Victoria, the RAB of gas transmission and distribution infrastructure is a third of the size of that of electricity infrastructure, but delivers a third more energy, and can support peak demand 60% higher. Relevant to customer interests, gas infrastructure also generates only 27% of the revenue of electricity, which is related both to the capital cost of the infrastructure and ongoing operational expenditure. Similarly, ACT gas infrastructure delivers 80% of the capacity of electricity infrastructure at 40% of the cost.

Analysis by the ARENA-funded Australia Hydrogen Centre further shows that the cost of converting gas infrastructure to deliver 100% hydrogen comes at a fraction of gas asset RAB. Analysis on South Australian and Victorian gas distribution networks shows that conversion of the gas network and all gas appliances to 100% hydrogen would increase distribution network stay-in-business capital expenditure to 2050 by 11-12% in present value terms[16]. This small cost of conversion indicates that today’s low cost of gas infrastructure will be retained when delivering renewable gases, even hydrogen, through existing gas infrastructure.

1.1.2 New gas infrastructure

Where new energy transport and storage infrastructure is required, pipeline infrastructure is a cost competitive option. This has been shown through recent pipeline and powerline infrastructure projects:

- APA’s 50km Western Outer Ring Main pipeline was completed in 2024 for approximately $185 million, or $3.7 million per kilometre. This project was in an urban environment, significantly adding to cost.

- APA’s $560km Northern Gas Interconnect was completed in 2023 for a cost of $821,000 per kilometre.

- AGIG’s 440km Tanami Natural Gas Pipeline, completed in 2019, cost $346 million or $786,000 per kilometre.

- The 360km HumeLink overhead transmission powerline project is expected to cost approximately $4.8 billion, or $13.3 million per kilometre.

- The proposed 400km Victoria – New South Wales Interconnector West overhead transmission project is expected to cost approximately $3.3 billion, or $8.25 million per kilometre. There are numerous reports that this cost will increase.

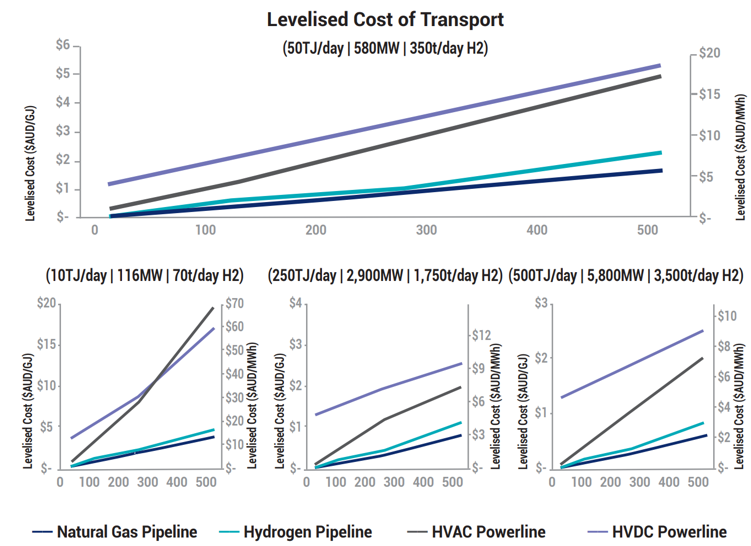

GPA Engineering’s Pipelines vs Powerlines report provides further details on this relationship[17]. Both gas and hydrogen transmission pipelines consistently cost less to deliver the same quantity of energy across the same distance in comparison to electricity transmission powerlines. An example of this relationship can be seen in Figure 3, outlining the cost of energy transport for a range of energy capacity scenarios over 500km. This outcome has since been supported by academic research within the Future Fuels CRC.

Figure 3: Levelised cost of energy transport via pipelines and powerlines[18]

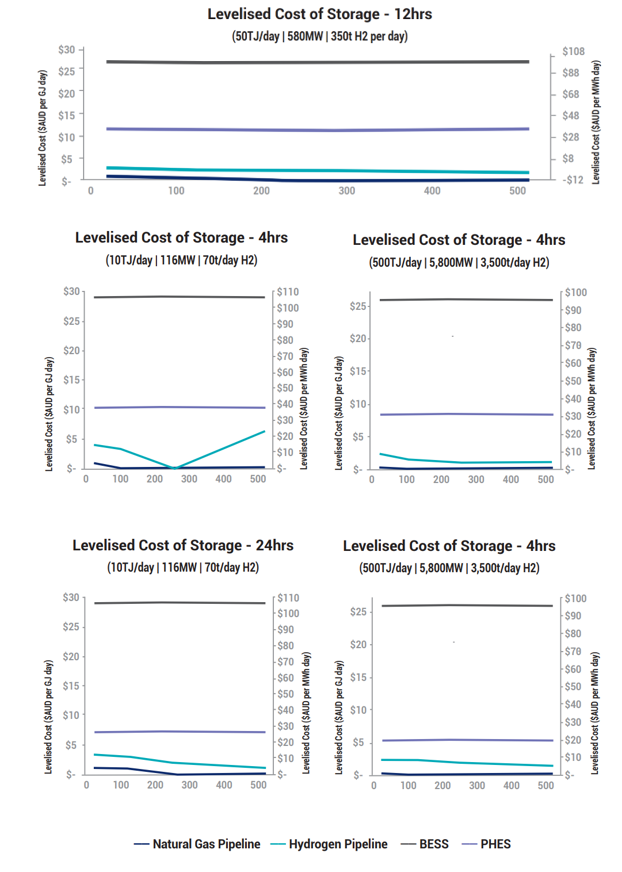

The economic benefits of new pipeline infrastructure extend beyond transport. GPA Engineering’s research also examined the levelised cost of energy storage between pipelines and battery (BESS) and pumped hydro (PHES) energy storage solutions, finding that energy storage in pipelines can be hundreds of times cheaper than energy storage in utility scale batteries or pumped hydro (Figure 4). GPA Engineering found that energy storage in hydrogen pipelines can be 2-to-36 times cheaper than energy storage in utility scale batteries or pumped hydro, excluding the instances in which it is essentially free.

Figure 4: Levelised cost of energy storage via pipeline linepack, BESS and PHES

1.1.3 Gas and hydrogen appliances

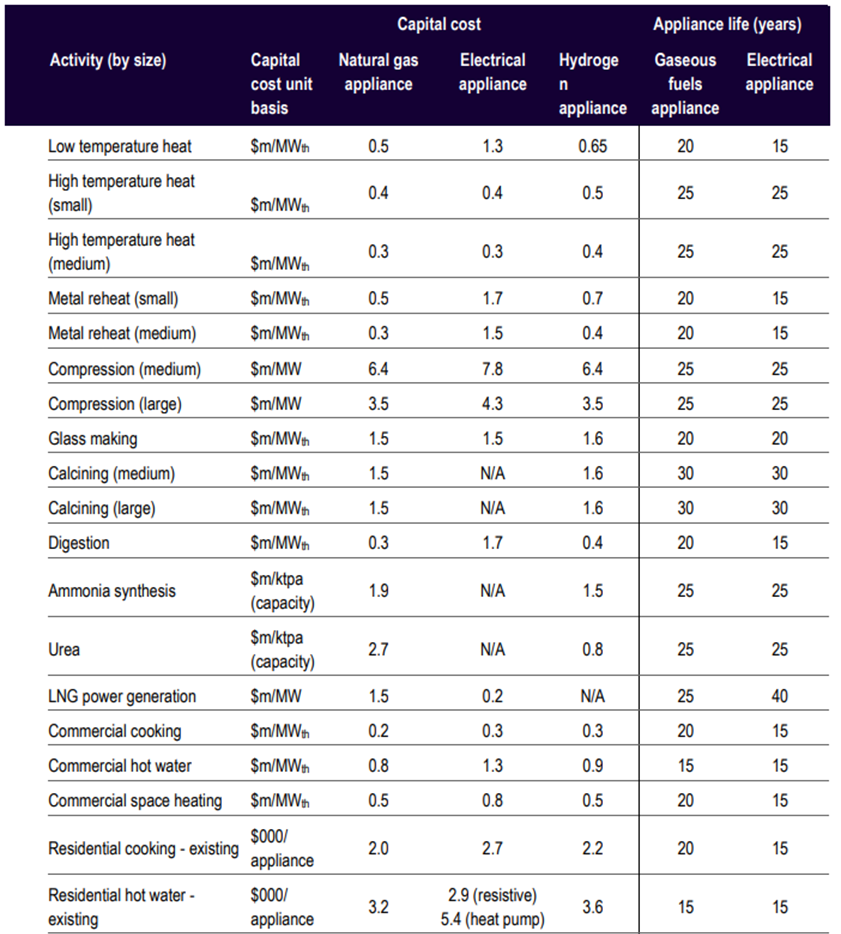

The technical simplicity of combusting gas makes gas and hydrogen appliances a cost-effective option in the majority of applications gas is used for today. Collating appliance cost assumptions for its economic analysis, ACIL Allen identified (Figure 5) that gas or hydrogen appliances were the equal or lowest cost appliance option for over three quarters of applications gas use used for today[19].

Considering the cost of decarbonising gas use, both energy cost and appliance cost needs to be taken into account. Focusing on only appliance cost or energy cost could lead to inaccurate conclusions being made about the least cost decarbonisation pathway.

Figure 5: Appliance capital cost and operating life assumptions[20]

1.2 Economic analysis of gas use decarbonisation

To assist gas customers to decarbonise, APGA and Energy Networks Australia (ENA) commissioned ACIL Allen to undertake economic analysis of gas use decarbonisation. A copy of the study is attached to this submission and APGA invites further conversation on this study and its implications. This section will explore analysis outcomes for the following topics:

- Renewable gas supply for gas customers which have no option to electrify

- Gas use decarbonisation at lowest overall cost

- Policy to deliver gas use decarbonisation at lowest overall cost.

Beyond considering these results, APGA strongly recommends that the Department replicates the modelling approaches seen within this study to assess policy options to deliver gas use decarbonisation at lowest overall cost.

1.2.1 Renewable gas supply for gas customers which cannot electrify

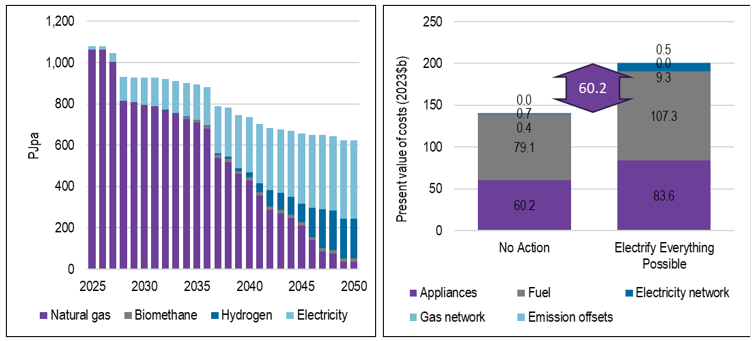

The analysis considered the least cost pathway to decarbonise gas use, while reserving renewable gases for those who cannot electrify. In this Electrify Everything Possible (EEP) scenario, all domestic gas customers which could electrify – i.e. have an electric appliance option – were required to electrify in order to decarbonise. The least cost decarbonisation trajectory was calculated in line with a net zero carbon budget.

Figure 6 below shows that the result is a steady electrification of gas demand over the window to 2050, with 210PJpa worth of renewable gases being required decarbonise customers unable to electrify.

Figure 6: EEP scenario – energy supply breakdown and cost comparison[21]

This demonstrates that a combination of renewable gas and renewable electricity is needed to decarbonise gas demand in Australia.

Unsurprisingly, this analysis also confirms that gas use decarbonisation will cost customers and the economy more than maintaining the carbon intensive status quo. Continuing to supply gas customers with natural gas through 2050 will require additional production and appliance replacement investments of around $140bn ($2023) through to 2050. Alternately, electrifying everything possible and supplying renewable gases to remaining gas customers is calculated to cost an additional $60.2bn ($2023), resulting in an average cost of abatement of around $165/tCO2e.

1.2.2 Gas use decarbonisation at lowest total cost

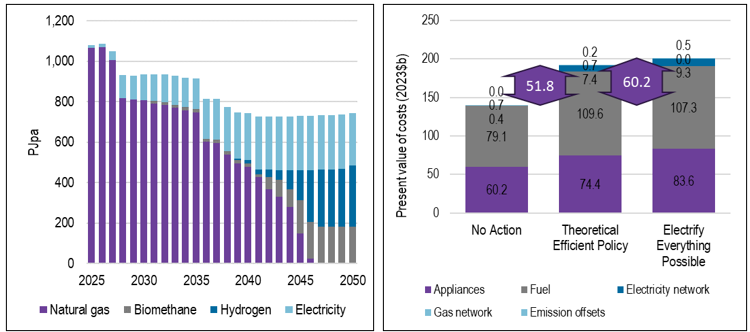

Public sentiment analysis indicates that the majority of Australian energy consumers are sensitive to the costs of decarbonisation[22]. Australian business representatives share this sentiment[23]. While the above EEP scenario requires customers electrify if they can, ACIL Allen also modelled the prospect that renewable gases could be a lower cost option for some customers.

Figure 7 shows the result of the Theoretically Efficient Policy (TEP) scenario, in which decarbonisation was guided by only the cost of energy and appliances and the same net zero carbon budget.

Figure 7: TEP scenario – energy supply breakdown and cost comparison[24]

These two charts show that without the requirement to electrify everything possible, the model selects renewable gas options in many applications. The lowest cost outcome was delivered using around 480PJpa of renewable gases and 260PJpa of renewable electricity in 2050.

This scenario reduces the additional cost to decarbonise by 14% to $51.8bn ($2023). Important to note is that the ratio of energy and appliance costs differ in this scenario – lower appliance costs in this scenario indicate a lesser burden being put on customers to finance the energy transition through their own, typically higher cost capital.

This outcome accords with the principles of market economics, where providing more options to achieve an outcome often results in lower costs overall. However, the implication is profound for the energy transition. Comparing the EEP and TEP scenarios indicates:

- Not allowing customers to choose the decarbonisation solution which suits their unique circumstances will increase the cost of the transition.

- There are gas customers which physically can electrify but could decarbonise through renewable gas purchases for lower cost.

- Policy supporting renewable gas production is critical to delivering gas use decarbonisation at least cost, rather than at any cost.

1.2.3 Policy to deliver the least cost gas use decarbonisation pathway

While the TEP scenario demonstrates the least cost transition pathway for gas use decarbonisation, it does not represent practical policy solution to implement. Instead, it reflects a pathway achieved through perfect foresight and timing of investments. The TEP is equivalent to introducing a carbon trading scheme with unlimited banking and borrowing.

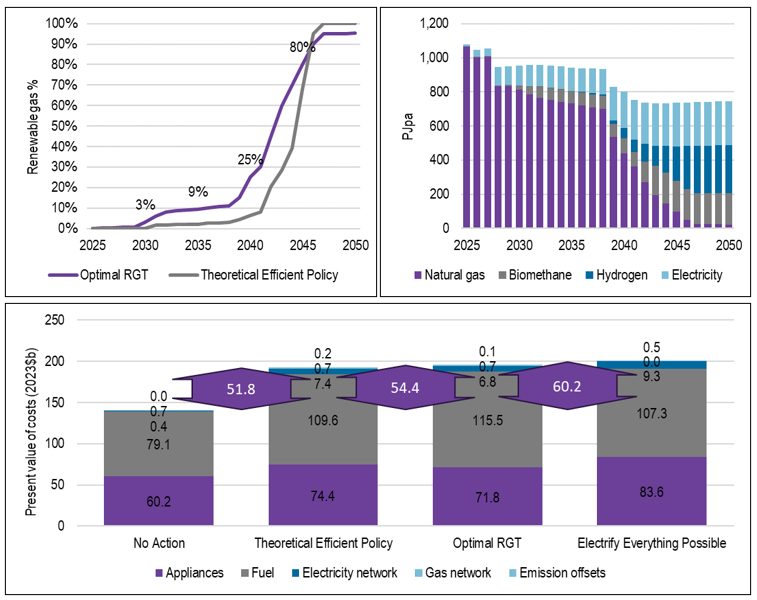

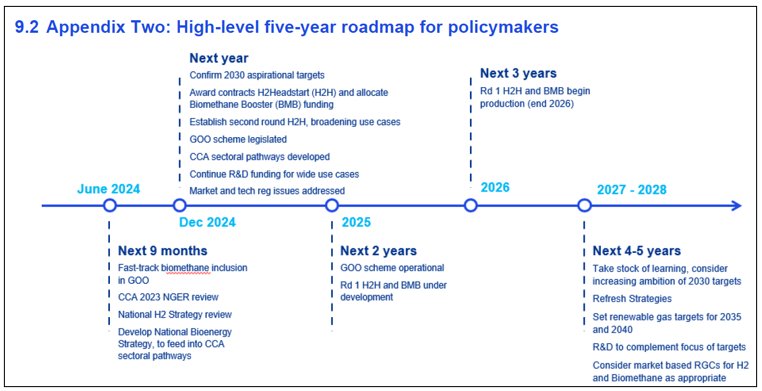

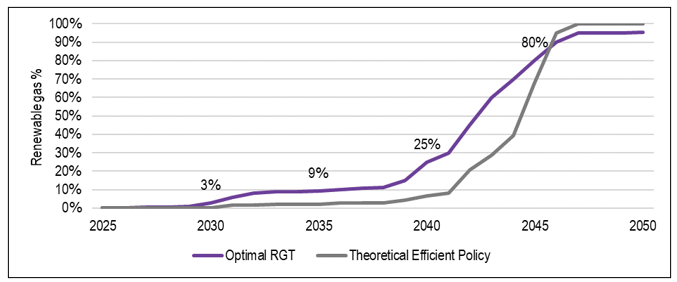

The Optimal Renewable Gas Target (RGT) was designed to deliver a practically implementable policy and based on past successful Australian energy policy (Figure 8). The intent of this scenario is to set targets of renewable gas as a percent of total gas demand between 2030 and 2050, which marginally brings forward renewable gas production, brings forward cost reduction learnings and flattens development costs in the 2040s.

Figure 8: Optimal RGT – RGT trajectory, energy supply breakdown and cost comparison[25]

The charts in Figure 8 show that by marginally bringing forward renewable gas supply, the Optimal RGT scenario secures gas use decarbonisation in line with the TEP scenario, while marginally increasing costs. Importantly, every gas customer for which it is lower cost to electrify is still able to choose to electrify under the Optimal RGT scenario.

The Optimal RGT scenario is not burdened with the same restrictions that increase cost in the EEP scenario. This scenario maintains the ability for customers to choose which decarbonisation option best suits their unique circumstances, and so reduces the cost of transition. The Optimal RGT scenario also results in lower appliance cost. This means that less of the capital cost burden of the transition falls on consumers.

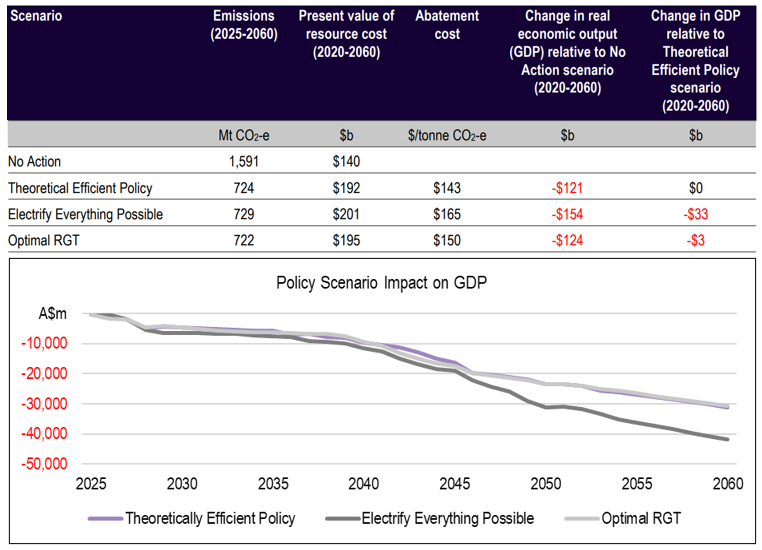

1.2.4 Importance of economic efficiency when decarbonising gas

All gas use decarbonisation cases considered in ACIL Allen modelling have a higher resource cost compared to simply continuing to use natural gas. The differences in these higher costs is important when considering the impact of the transition on Gross Domestic Product (GDP).

When considering gas decarbonisation at a macroeconomic level, the higher cost of the EEP scenario is amplified. Relative to the least cost TEP scenario, the EEP scenario is 11 times more costly to GDP (-$33bn in $2023) than the Optimal RGT scenario (-$3bn in $2023) (Figure 9). This highlights the importance of economically efficient energy policy as any inefficiencies at the microeconomic level are amplified at the macroeconomic level.

Figure 9: Impacts of gas decarbonisation policy choices on GDP

1.3 Policy support for gas use decarbonisation

The policy focus areas identified for decarbonising liquid fuels in Section 4.7 of the Discussion Paper can be applied to decarbonising gas supply. Each of the four areas are equally applicable to the renewable gas transition as the renewable liquid fuel transition. Table 3 below maps these policy focus areas to the gas supply chain, including policy actions proposed by APGA.

APGA recommends that the EEPS take the same approach to policy focus areas to enable renewable gases.

Table 3: Renewable gas policy focus areas and associated policy actions

In some regards, the decarbonisation of gas supply is ahead of liquid fuels. Amendments passed in 2023 extended the National Gas Law (NGL) to renewable gases, extending recent supply security and reliability reforms to renewable gas supply. This ensures that gas security and reliability is maintained and supply chain vulnerabilities are managed. The recently published National Energy Performance Strategy (NEPS) includes consideration of gas appliance efficiency which will support reducing fossil-based gas demand. Decarbonising Australia’s gas supply is the logical next step.

1.3.1 Policy support to decarbonise our gaseous fuel mix

Analysis by KPMG of policy mechanisms supports the economic analysis of ACIL Allen by identifying past successful policy mechanisms which are appropriate to apply to the renewable gas challenge (Figure 10).

APGA identifies three policy mechanisms as being key to enable renewable gas to decarbonise gas use in Australia:

- Immediate: Enabling renewable gas markets via NGER recognition of renewable gas certificates;

- Medium term: Sending an investment signal through the introduction of an aspirational national Renewable Gas Target within Australia’s emission targets; and

- Longer term: Avoiding increased energy costs while ensuring targets are met through federally-funded contracts for difference (CfD) schemes targeting renewable gas costs above the cost of natural gas.

At a minimum, APGA recommends the Federal Government undertake modelling to inform its policy development, which considers least cost gas use decarbonisation similar to the ACIL Allen analysis.

Figure 10: KPMG High-level five-year roadmap for policymakers[30]

1.3.1.1 NGER recognition of renewable gas certificates

Renewable gases do cost more than natural gas. To justify paying a higher price, wholesale gas customers must be able to gain additional value beyond energy supply alone when purchasing renewable gas. The additional value which renewable gases can provide is through emissions reduction: the energy is provided at less than 1% of the scope 1 emissions of natural gas. For customers to gain access to this value, the NGER Measurement Determination needs to be updated to include a market-based method for accounting for Scope 1 gas emissions.

This is not a new idea. Introduction of a market-based method for Scope 1 gas emissions was recommended by the Climate Change Authority in its December 2023 NGER review report[31]. Such a method already exists for scope 2 emissions accounting for renewable electricity certificates. Renewable gas industry and customers have been requesting this relatively simple policy change for some time – a change which is key to Safeguard Mechanism Facilities being able decarbonise through renewable gas supply.

A market-based method for gas could recognise the surrender of renewable gas certificates issued by Australian state or Federal governments, departments, or agencies. The GreenPower Renewable Gas Certification pilot is already producing Renewable Gas Guarantee of Origin (RGGO) certificates. This scheme could form a basis for design before the Federal Guarantee of Origin (GO) Scheme is finalised, or as an alternative to the GO Scheme.

Design for certificates beyond the GO Scheme is important. Currently, the design of the GO Scheme makes it impossible to integrate with Australia’s facilitated gas markets[32]. Additionally, the GO Scheme does not consider biomethane -Australia’s lowest cost renewable gas option. The GreenPower scheme does not have these issues.

1.3.1.2 A National Renewable Gas Target (RGT)

It is difficult to see how 2035 targets can be set without understanding the extent to which natural gas use will be decarbonised in the next decade. This makes a renewable gas target an essential input to 2035 economy wide target.

Setting ambitious decarbonisation targets has been a key policy mechanism used by Australian state and Federal governments. While the impact of the Renewable Energy Target (RET) on renewable electricity production makes it Australia’s most successful target, more recent schemes indicate the value of simple, aspirational targets in framing renewable energy investment opportunities. As is the case with Australia’s 82% by 2030 renewable electricity target, aspirational targets can also leverage government funding to drive public investment – as seen through the Capacity Investment Scheme.

Target Pathway

Through the Optimal RGT scenario, ACIL Allen identifies a National RGT pathway that secures a least cost gas use decarbonisation pathway. A National RGT design could be made simple yet agile by setting renewable gas quantity targets every five years, based on a desired renewable gas percentage of total gas supply (Figure 11). As seen through the RET, regular percentage-based quantity setting ensures that targets remain relevant to Australia’s changing energy needs, avoiding over- or under-ambition.

Figure 11: Optimal RGT – Renewable gas target as a percentage of all gas consumption

Value of a National Target over state-based targets

ACIL Allen’s renewable gas supply availability and cost findings demonstrate that not all states are equally abundant in renewable gas supply opportunities. However, both the operation of the east coast gas market and ACIL Allen’s modelling shows that gases – including renewable gases – can be moved cheaply and efficiently between states. This is in part due to Australia’s world class gas transmission pipeline infrastructure which transports gas across the country today.

This indicates that a National RGT can secure lower decarbonisation costs, compared to a state-by-state approach. This is a key reason why ACIL Allen’s analyses and the Victorian Government’s analyses differ – when only considering renewable gas supply from Victoria, the opportunity for renewable gas in Victoria looks much poorer than shown in national modelling.

1.3.1.3 Federally funded contracts for difference

All forms of gas decarbonisation cost more than remaining on natural gas. This must be addressed through the transition as decarbonisation will have cost implications across the economy. It is important that this fact does not prevent the first renewable gas production projects from reaching FID.

Federally-funded CfD, pinned to wholesale natural gas prices, could ensure renewable gas production projects are guaranteed the revenue they need to achieve FID while addressing the cost-of-living concern of potentially higher gas prices. This scheme would be consistent with the intent of the Made in Australia Act and could mirror other such schemes including the Capacity Investment Scheme.

2 Gas enables net zero electricity in Australia

Today’s gas supply chain helps keep electricity prices low and reliability and security high. This parallel energy supply chain does so directly by fuelling GPG, and indirectly by reducing electricity system load through supplying large volumes of energy to gas customers.

As Australia transitions towards net zero, a decarbonised gas supply chain can continue to perform this role. It can do so by firming variable renewable generation in a net zero NEM and reducing electricity system demand by supplying energy to those gas customers which need decarbonise via renewable gas for practical or economic reasons.

2.1 GPG helps Australia achieve net zero electricity

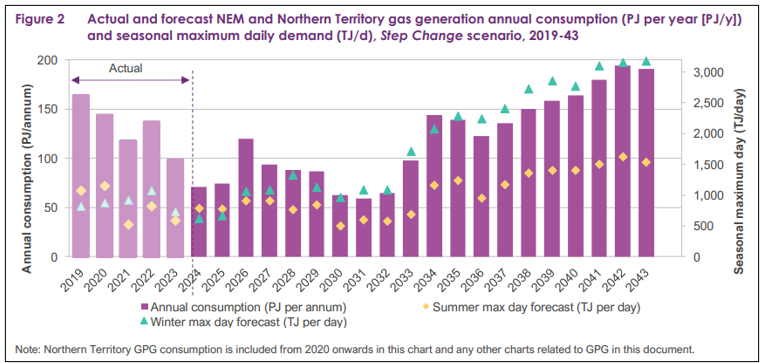

There is no doubt about the critical role that GPG plays in achieving net zero electricity in Australia. AEMO analysis shows over 4.4x the GPG capacity used in 2023 is required to supply winter peak demand in the 2040’s in line with their net zero consistent Step Change scenario[33] (Figure 12). Analysis by Frontier Economics indicates that a net zero NEM can be achieved at least cost through 93% variable renewable generation and 7% GPG[34]. Frontier Economics also determined that GPG has whole of system cost (WESC) equal to or less than solar in a paper considering the impracticalities of levelised cost analysis in the transition to electricity systems with increasing levels of variable generation[35].

Figure 12: AEMO Gas Statement of Opportunities GPG Forecast

Public sentiment analysis indicates that the majority of Australian energy consumers are sensitive to the costs of decarbonisation [36]. While it is technically possible to firm the NEM without GPG, it will be necessary to achieving net zero at least cost.

Importantly, GPG doesn’t have to remain carbon intensive. Biomethane is 100% compatible with GPG today, and projects including the South Australian Hydrogen Jobs Plan Power Plant Project are on their way to Australian-first demonstrations of 100% renewable GPG. GPG remains a competitive firming option even with renewable gas prices as high as $50/GJ[37].

Without GPG, the NEM falls back on using the next most readily available generation source – coal fired generation. The fact that it is GPG being squeezed out of the NEM while coal generation remains competitive indicates the challenge of achieving lower emissions within the electricity market. Government policy is required to ensuring sufficient competitive GPG is brought online in time for the 2030s in order to avoid more circumstances in which state governments need to underwrite continued coal fired generation that is otherwise ready for retirement[38].

2.1.1 Policy support to ensure GPG investment

Despite this widely recognised and critical role, GPG has been omitted from the Capacity Investment Scheme (CIS). This creates an imbalance in investment incentives against GPG, which puts achieving a net zero NEM at risk. This is because this imbalance in investment incentives risks:

- Driving investors in existing GPG out of the market; and

- Deterring potential investors away from investing in the additional GPG the country needs to achieve net zero at least cost.

Including GPG into the CIS would be the simplest way to address this imbalance. Otherwise, a separate targeted scheme is required to ensure the necessary GPG capacity is delivered in time. This scheme could be designed to target delivery of the capacity requirements identified by AEMO’s GSOO and/or ISP in the years before they are required.

2.2 Decarbonising gas supply takes pressure off a net zero NEM

A big part of achieving net zero electricity and ensuring reliability and security of supply is the scale of uplift required across the coming decades. The scale of change to the Australian electricity system is unprecedented. If there are options to reduce the strain on this system while still achieving a net zero outcome, other important outcomes including energy equity, reliability and security can be more easily achieved.

There is an opportunity for the resilience of a net zero NEM to be optimised by considering:

- Alternative energy infrastructure; and

- Reducing overall demand.

Alternative energy infrastructure

- The NEM is already the longest electricity transmission system in the world. Keeping costs low while maintaining reliability and security of supply, all while increasing variable generation and demand, will be a key challenge of the transition.

- More electricity storage and transmission powerlines will also increase the cost of the NEM, increasing bill costs. Any option to optimise energy infrastructure costs should be taken.

- The hydrogen supply chain can help optimise the electricity supply chain as energy transport and storage using hydrogen pipelines is cheaper than electric alternatives.

Reducing overall demand

- Today, gas and electricity systems share domestic energy demand at a ratio of 20% electricity and 24% gas.

- While many gas customers will electrify, other gas customers will need to stay on the gas system as it decarbonises for practical or economic reasons.

- If continuing to consume energy from a next zero gas supply chain is the right choice for particular gas customers, then this reduces the load – and hence the reliability and security of supply challenge – on a future net zero NEM.

2.2.1 Policy to decarbonise gas supply

The same policy options proposed to decarbonise gas supply will enable a steadily decarbonising gas supply chain to take pressure off a net zero NEM. This demonstrates the value of Australian maintaining parallel and complimentary renewable electricity and renewable gas supply chains in a net zero future. With both supply chains able to firm supply and optimise demand of the other, Australian energy consumers can be the recipients of an optimised net zero energy system able to cater to each consumers unique energy needs.

[1] See Section 1.1 of this submission for further details.

[2] See Section 1.3 of this submission for further details.

[3] AEMO, 2024, Draft 2024 Integrated Systems Plan, https://aemo.com.au/-/media/files/stakeholder_consultation/consultations/nem-consultations/2023/draft-2024-isp-consultation/draft-2024-isp.pdf

[4] APGA, Climate Statement, available at: https://www.apga.org.au/apga-climate-statement

[5] APGA, 2020, Gas Vision 2050, https://www.apga.org.au/sites/default/files/uploaded-content/website-content/gasinnovation_04.pdf

[6] Future Fuels CRC: https://www.futurefuelscrc.com/

[7] DCCEEW, 2023, Australian Energy Update 2023, https://www.energy.gov.au/sites/default/files/Australian%20Energy%20Update%202023_0.pdf

[8] Grattan Institute, 2021, Towards net zero: Practical policies for reducing industrial emissions, https://grattan.edu.au/wp-content/uploads/2021/08/Towards-net-zero-Practical-policies-to-reduce-industrial-emissions-Grattan-report.pdf

[9] DCCEEW, 2023, Australian Energy Update 2023.

[10] GPA Engineering, 2022, Pipelines vs Powerlines: A Technoeconomic Analysis in the Australian Context available at https://www.apga.org.au/sites/default/files/uploaded-content/field_f_content_file/pipelines_vs_powerlines_-_a_technoeconomic_analysis_in_the_australian_context.pdf

[11] Bluescope, 2023, Sustainability Report FY2023, https://www.bluescope.com/content/dam/bluescope/corporate/bluescope-com/sustainability/documents/2023_BlueScope_Report_Sustainability_Report.pdf; Fuller K, 2024, ‘BlueScope, Rio Tinto and BHP join forces on plan for low carbon steel future’, in ABC News Illawarra, https://www.abc.net.au/news/2024-02-09/green-steel-push-bluescope-bhp-rio-tinto-join-forces-carbon-plan/103447174

[12] BHP, 2023, Operational decarbonisation, https://www.bhp.com/-/media/documents/media/reports-and-presentations/2023/230621_operationaldecarbonisationinvestorbriefing.pdf

[13] Boston Consulting Group, 2023, The role of gas infrastructure in Australia’s energy transition, https://39713956.fs1.hubspotusercontent-na1.net/hubfs/39713956/The-Role-of-Gas-Infrastrcuture-in-Australia-s-Energy-Transition.pdf

[14] APGA, 2021, Submission: Victorian Gas Substitution Roadmap Consultation Paper, https://www.apga.org.au/sites/default/files/uploaded-content/field_f_content_file/210816_apga_submission_to_the_victorian_gas_substitution_roadmap_consultation_paper.pdf

[15] APGA, 2023, Submission: Regulating for the prevention of new fossil fuel gas network connections, https://www.apga.org.au/sites/default/files/uploaded-content/field_f_content_file/230420_apga_submission_-_act_gas_connections.pdf

[16] Australian Hydrogen Centre, 2023, 100% Hydrogen Distribution Networks: Victoria Feasibility Study, https://arena.gov.au/assets/2023/09/AHC-100-Hydrogen-Distribution-Networks-Victoria-Feasibility-Study.pdf; Australian Hydrogen Centre, 2023, 100% Hydrogen Distribution Networks: South Australia Feasibility Study,

[17] GPA Engineering, 2022, Pipelines vs Powerlines: A Technoeconomic Analysis in the Australian Context.

[18] Ibid.

[19] See Attachment 1

[20] See Attachment 1; note there is more appliance cost detail in Attachment 1 then shown in this document.

[21] ACIL Allen, 2024, Renewable Gas Target: Delivering lower cost decarbonisation for gas customers and the Australian economy, commissioned by APGA and ENA.

[22] RedBridge, 2024, EnergyShift Australia, commissioned by APGA, https://apga.org.au/research-and-other-reports/energyshift-australia

[23] Victorian Chamber of Commerce and Industry, 2024, Gas: a burning issue, https://www.victorianchamber.com.au/news/gas-a-burning-issue

[24] ACIL Allen, 2024, Renewable Gas Target: Delivering lower cost decarbonisation for gas customers and the Australian economy, commissioned by APGA and ENA.

[25] ACIL Allen, 2024, Renewable Gas Target: Delivering lower cost decarbonisation for gas customers and the Australian economy, commissioned by APGA and ENA.

[26] DCCEEW, 2024, National Energy Performance Strategy, https://www.dcceew.gov.au/energy/strategies-and-frameworks/national-energy-performance-strategy

[27] DCCEEW, 2023, Extending the national gas regulatory framework to hydrogen and renewable gases, https://www.energy.gov.au/energy-and-climate-change-ministerial-council/working-groups/gas-working-group/gas/extending-national-gas-regulatory-framework-hydrogen-and-renewable-gases

[28] AEMO, 2023, East Coast Gas Reforms, https://aemo.com.au/en/initiatives/major-programs/east-coast-gas-reforms

[29] Including through the National Gas Emergency Response Advisory Committee; see AEMO, 2024, National role, https://www.aemo.com.au/energy-systems/gas/emergency-management/national-role

[30] KPMG, 2023, Renewable gas: policy options to support Australia’s decarbonisation journey, https://www.energynetworks.com.au/resources/reports/kpmg-report-policy-options-to-support-australias-decarbonisation-journey

[31] Climate Change Authority, 2023, 2023 Review of the National Greenhouse and Energy Reporting Legislation, https://www.climatechangeauthority.gov.au/sites/default/files/documents/2023-12/2023%20NGER%20Review%20-%20for%20publication.pdf

[32] APGA, 2023, Submission: Guarantee of Origin Scheme Accounting, https://apga.org.au/submissions/guarantee-of-origin-scheme-emissions-accounting; APGA, 2023, Submission: Guarantee of Origin Scheme Design, https://apga.org.au/submissions/guarantee-of-origin-scheme-design; APGA, 2023, Submission: Australia’s Guarantee of Origin Scheme, https://apga.org.au/submissions/australias-guarantee-of-origin-scheme

[33] AEMO, 2024, 2024 Gas Statement of Opportunities, https://aemo.com.au/-/media/files/gas/national_planning_and_forecasting/gsoo/2024/aemo-2024-gas-statement-of-opportunities-gsoo-report.pdf

[34] Frontier Economics, 2021, Potential for Gas-Powered Generation to support renewables, commissioned by APGA, https://apga.org.au/research-and-other-reports/potential-for-gas-powered-generation-to-support-renewables

[35] Frontier Economics, 2021, The role of gas in the transition to net-zero power generation, commissioned by the Australian Gas Industry Trust and Jemena, https://apga.org.au/research-and-other-reports/the-role-of-gas-in-the-transition-to-net-zero-generation

[36] RedBridge, 2024, EnergyShift Australia, commissioned by APGA, https://apga.org.au/research-and-other-reports/energyshift-australia

[37] Gilmore J, Nelson T, Nolan T, Firming technologies to reach 100% renewable energy production in Australia’s National Electricity Market (NEM), https://www.energy.gov.au/sites/default/files/2022-02/Iberdrola%20Australia%20Response%20to%20Capacity%20Mechanism%20Project%20Initiation%20Paper%20-%20Attachment%201.pdf

[38] NSW Office of Energy and Climate Change, 2023, Electricity Supply and Reliability Check Up: NSW Government Response, https://www.energy.nsw.gov.au/sites/default/files/2023-09/Electricity_Supply_and_Reliability_CheckUp_NSW_Government_Response_September_2023.pdf; Office of the Premier of Victoria, 2023, Agreement Secures Transition For Loy Yang A, https://www.premier.vic.gov.au/agreement-secures-transition-loy-yang