25 March 2024

Submission: Expanded Capacity Investment Scheme Design

The Australian Pipelines and Gas Association (APGA) represents the owners, operators, designers, constructors and service providers of Australia’s pipeline infrastructure, connecting natural and renewable gas production to demand centres in cities and other locations across Australia. Offering a wide range of services to gas users, retailers and producers, APGA members ensure the safe and reliable delivery of 28 per cent of the end-use energy consumed in Australia and are at the forefront of Australia’s renewable gas industry, helping achieve net-zero as quickly and affordably as possible.

APGA supports a net zero emission future for Australia by 2050[1]. Renewable gases represent a real, technically viable approach to lowest-cost energy decarbonisation in Australia. As set out in Gas Vision 2050[2], APGA sees renewable gases such as hydrogen and biomethane playing a critical role in decarbonising gas use for both wholesale and retail customers. APGA is the largest industry contributor to the Future Fuels CRC[3], which has over 80 research projects dedicated to leveraging the value of Australia’s gas infrastructure to deliver decarbonised energy to homes, businesses, and industry throughout Australia.

APGA welcomes the opportunity to contribute to the Department of Climate Change, Energy, Environment and Water’s consultation on the design of the expanded Capacity Investment Scheme (CIS). The CIS will be an important enabler of Australia’s energy transition, but its potential impact on increasing generation capacity has been blunted by its exclusion of gas power generation.

The CIS is intended to support investment in capacity, to meet Federal Government targets of 82% renewable electricity by 2030 through an additional 32 GW of capacity by 2030. And as the energy transition progresses – with an increase in variable renewable energy generation, and the retirement of coal-fired generation – gas will become more important, not less. The current design of the CIS will make it more difficult to invest in the GPG capacity necessary to underpin that transition.

APGA recommends that the Capacity Investment Scheme be extended to include gas powered generation (GPG), or a similar scheme to provide the long-term investment signals necessary to support investment in GPG capacity. APGA also recommends that AEMO invest in multi-vector, high resolution energy modelling which includes gas supply and networks.

ISP highlights scale of the gas power generation capacity challenge

In the Draft 2024 Integrated Systems Plan (ISP), the Australian Energy Market Operator recognises the critical importance of GPG in reaching net zero.

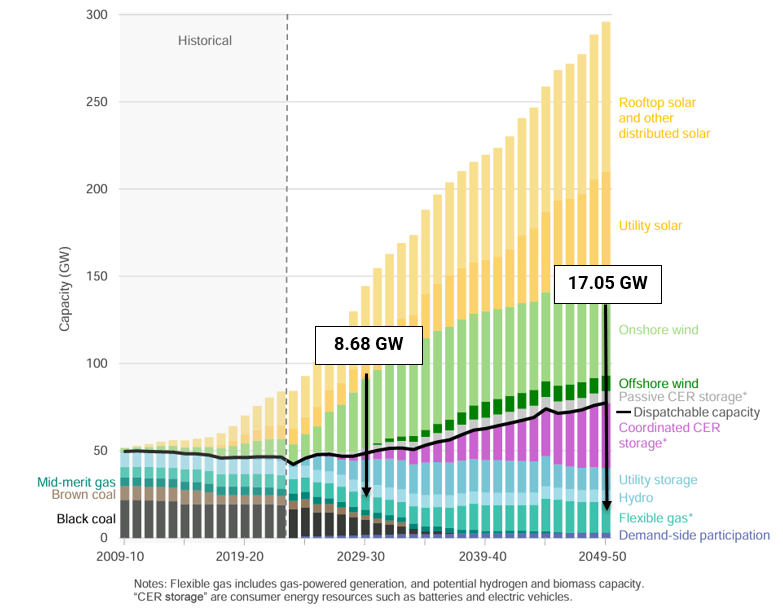

The Draft ISP forecasts that by 2050 under the Step Change Scenario, the National Energy Market (NEM) will need a total of 17 GW of flexible GPG (Figure 1). This trajectory effectively doubles capacity from 8.7 GW in 2030 – at the time when the CIS is scheduled to cease.

Figure 1: Forecast capacity the NEM (GW, 2009-10 to 2049-50, Step Change)

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

In the ISP’s Optimal Development Pathway based on this scenario, GPG capacity is 16 GW by 2050, up from 10 GW in the 2022 ISP.

At present, there is approximately 8.2 GW of flexible GPG capacity. The ISP projects only incremental increases between now and the early 2030s, when capacity begins to rapidly ramp up, more than doubling over the following fifteen years. The ISP does not specify how this investment is to be made, only that it must, calling for investment that would:

Almost quadruple the firming capacity from sources alternative to coal that can respond to a dispatch signal, using utility-scale batteries, pumped hydro and other hydro, coordinated consumer energy resources as “virtual power plants” (VPPs), and gas-powered generation.[4]

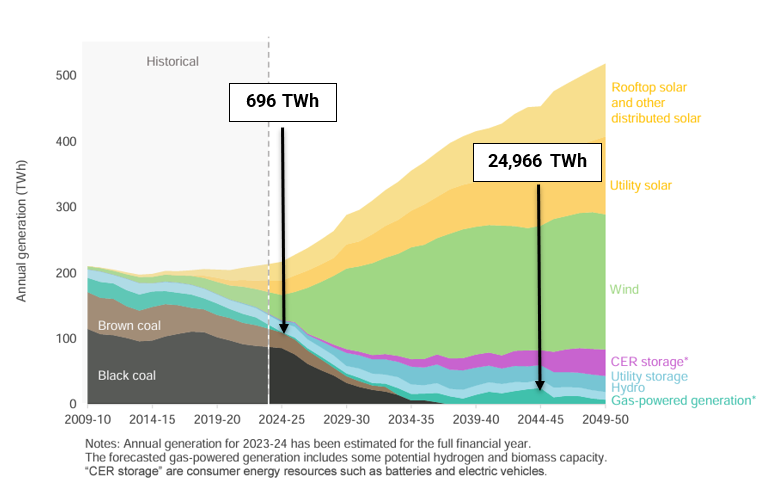

At the same time, the ISP projects that the actual contribution of GPG to the generation mix in the NEM under the same scenario will fluctuate considerably over the period to 2050. The model predicts GPG will climb from record lows of 700 TWh to a peak of 25,000 TWh in 2044-45 (Figure 2).

Figure 2: Forecast generation mix in the NEM (TWh, 2009-10 to 2049-50, Step Change)

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

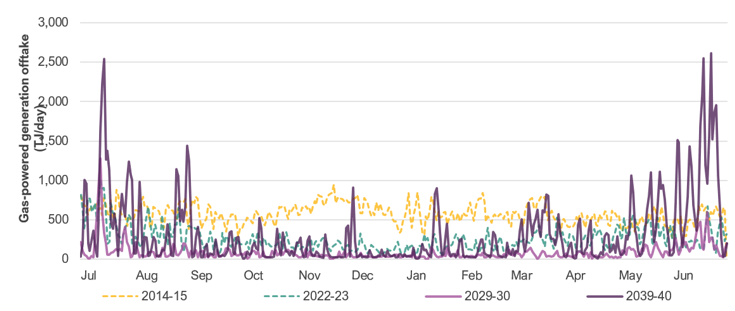

The Draft ISP also demonstrates an expectation that GPG will become a critical backstop. Projected winter demand peaks for GPG grow drastically in 2039-40 (Figure 3), with several days requiring over 2,500 TJ/day.

It is worth noting that this projected offtake is well in excess of current generation capacity, and that additional investments may be required to gas transport and storage infrastructure to meet this peak demand.

Figure 3. Forecast gas-powered generation offtake in the NEM (TJ/day, 2014-15 to 2039-40, Step Change)

Source: AEMO, 2023, Draft 2024 Integrated System Plan.

The ISP concurs with the necessity of additional infrastructure investment to manage potential pipeline and other gas infrastructure bottlenecks in peak generation periods:

These peaks are forecast to test the limitations of the gas supply network, and solutions will be needed to address them.[5]

The current CIS cannot solve this future capacity gap

The CIS excludes thermal generation from eligibility for tenders, even for dispatchable capacity. Accordingly future investors in GPG will need to compete against dispatchable investments that have been able to take advantage of the scheme before the expected ramp-up of GPG following the end of the CIS in 2030.

In the absence of incentives like the CIS or similar scheme, the investment case for GPG is turbulent. Because the plants are only dispatched a few times a year, it can be challenging to recover the investment and fixed costs of power generation, especially considering the expected capacity requirements vs forecast generation in the ISP:

This gas generation is a strategic reserve for power system reliability and security, so is not forecast to run frequently. A typical gas generator may generate just 5% of its annual potential, but will be critical when it runs.[6]

The uncertainty of gas supply and demand volumes – exacerbated by poor demand forecasting – and additional costs imposed by emissions reduction policies introduces additional investment risk. For these reasons, it may be difficult to maintain investment in existing GPG or bring GPG projects to Final Investment Decision in the market.

It is also worth noting that the ISP does not consider what incentives or investments would be required to keep existing GPG in the market, to both meet near term demand and the ISP’s projected demand from 2030. Without such incentives, it is not guaranteed that existing GPG will remain in the market long enough to form a foundation for future capacity investment.

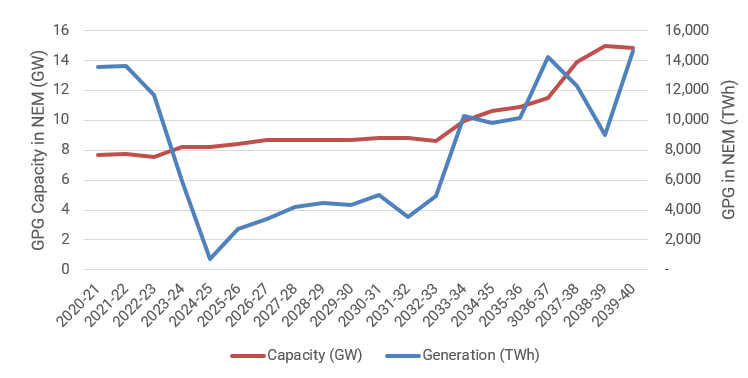

Closer analysis shows the ISP forecasts a sustained period with a relatively small amount of gas generation over the period 2024-25 to 2033-34, with capacity remaining steady at its current levels or slightly above (Figure 4). This demonstrates what may be a period of low revenue for existing GPG operators, which may prompt an earlier exit from the market than otherwise planned. This will not be solved by the CIS, or by any other government program or incentive to date.

Figure 4: Forecast GPG capacity and generation in the NEM (2020-21 to 2039-40, Step Change)

Source: APGA analysis of AEMO, 2023, Draft 2024 Integrated System Plan.

In short, the ISP projects critical reliance on GPG out to 2050 but in the absence of government mechanisms or incentives it is unclear how those investments will be made post-2030, or existing GPG operators kept in the current market.

APGA Recommendations

APGA recommends including gas power generation in the CIS, or considering a scheme that provides the long-term investment signals necessary to support investment in GPG.

In the absence of incentives, existing GPG may be reluctant to remain in the market and new investments in GPG may not be sufficient to develop the capacity required from 2033. If GPG is to meet the projections in the ISP, the Australian Government must investigate long-term availability or capacity payments to provide sufficient incentive for GPG to remain in the market and to promote long-term investment.

APGA echoes its recommendation previously made in its 2024-25 Federal Budget submission:[7] the Australian Government should include gas power generation in the capacity investment scheme or consider a scheme that provides the long-term investment signals necessary to support investment in gas power generation.

APGA recommends the Australian Government also commission multi-vector, high resolution energy modelling. This would complement the existing electricity model, considering future gas supply and network economics with the introduction of renewable gases at a minimum.

APGA has been transparent on many occasions in advising AEMO that its existing models are not able to accurately represent the gas market, most recently in our submission to the Draft 2024 ISP.[8] AEMO’s gas forecasts have consistently underestimated gas power generation consumption, and has not accurately modelled gas use transition[9] and are considered unreliable for gas market operators for the purposes of contracting sufficient supply.

As gas will be a critical contributor to the energy transition it is vital that this modelling is improved, both in scale and resolution.

To discuss any of the above feedback further, please contact me on +61 422 057 856 or jmccollum@apga.org.au.

Yours sincerely,

JORDAN MCCOLLUM

National Policy Manager

Australian Pipelines and Gas Association

[1] APGA, Climate Statement, available at: https://www.apga.org.au/apga-climate-statement

[2] APGA, 2020, Gas Vision 2050, https://apga.org.au/gas-vision-2050

[3] Future Fuels CRC: https://www.futurefuelscrc.com/

[4] AEMO, 2023, Draft 2024 Integrated System Plan, p. 10

[5] AEMO, 2023, Draft 2024 Integrated System Plan, p. 65

[6] Ibid.

[7] APGA, 2024, Submission: 2024-25 Federal Budget, https://apga.org.au/submissions/2024-25-federal-budget

[8] APGA, 2023, Submission: Draft 2023 Integrated Systems Plan, https://apga.org.au/submissions/draft-2024-integrated-services-plan

[9] Frontier Economics, 2021, The role of gas in the transition to net-zero power generation, https://www.apga.org.au/sites/default/files/uploaded-content/field_f_content_file/frontier-economics-report-stc.pdf