Submission: NSW Consumer Energy Strategy

The Australian Pipelines and Gas Association (APGA) represents the owners, operators, designers, constructors and service providers of Australia’s pipeline infrastructure, connecting natural and renewable gas production to demand centres in cities and other locations across Australia. Offering a wide range of services to gas users, retailers and producers, APGA members ensure the safe and reliable delivery of 28 per cent of the end-use energy consumed in Australia and are at the forefront of Australia’s renewable gas industry, helping achieve net-zero as quickly and affordably as possible.

APGA welcomes the opportunity to contribute to the NSW Department of Climate Change, Energy, Environment and Water consultation on developing a Consumer Energy Strategy (CES) for households.

APGA supports a net zero emission future for Australia by 2050[1]. Renewable gases represent a real, technically viable approach to lowest-cost energy decarbonisation in Australia. As set out in Gas Vision 2050[2], APGA sees renewable gases such as hydrogen and biomethane playing a critical role in decarbonising gas use for both wholesale and retail customers. APGA is the largest industry contributor to the Future Fuels CRC[3], which has over 80 research projects dedicated to leveraging the value of Australia’s gas infrastructure to deliver decarbonised energy to homes, businesses, and industry throughout Australia.

Consumer energy resources (CER) are a large focus of Australia’s decarbonisation. While targets and incentives have helped bring solar, battery, and other technologies down the cost curve, it is sensible now consider what decarbonisation efforts produce the best ‘bang for buck’ and what further incentives are necessary. Work by the Boston Consulting Group (BCG), detailed below, shows another option: the importance of a whole-of-economy approach and the contribution renewable gas can make to Australia’s energy transition.

APGA recommends that energy decarbonisation policies reflect the option for energy customers to decarbonise gas via renewable gas uptake.

The consultation paper includes electrification of gas in its definition of CER. APGA disagrees with this, for one because electrification of gas is not itself a physical energy resource, but also as it assumes that electrification of household gas use is the only decarbonisation option. In reality there is another option in renewable gas.

APGA does not support government policy which limits decarbonisation options available to consumers, and effectively picks winners in what should be an open market. Governments should avoid policy which unevenly levies decarbonisation costs on some customer segments – such as lower income households who cannot afford to participate in energy efficiency and electrification schemes, or gas-using households more generally. Any future incentives or other policy for CER should avoid delivering poor outcomes for customers by prioritising electrification over renewable gas, where renewable gas is cost competitive or cheaper than electrification.

APGA recommends that the NSW Government heed the lessons of the Victorian Government’s Victorian Energy Upgrades (VEU) program.

The NSW Government has the opportunity to learn lessons from the Victorian Government’s implementation of the VEU program. As identified by St Vincent de Paul Society, by requiring energy retailers to purchase VEU certificates, the VEU draws funding from all energy customers, including Victoria’s lowest income households, to fund higher-cost electric appliance installation for those who can afford to electrify.[4]

APGA recommends the NSW Government focus on consumer equity when developing policy to support CER in NSW.

Subsidies and targets can risk transferring wealth from poorer households to more affluent households, increasing the cost of living for all low-income households. In doing so, substantial social licence issues may arise for state decarbonisation policy. The NSW Government should prioritise equitable access to CER, as well as equitable access to cost competitive or lower cost decarbonisation through renewable gas uptake.

Best value emissions reduction through dual decarbonisation pathways

The NSW Government should prioritise dual decarbonisation pathway for all sectors – enabling both renewable electricity and renewable gas options. Work undertaken by BCG in 2023[5] demonstrated how to achieve this by prioritising the displacement of coal generation, liquid fuels used in light vehicles, and low-grade industrial heating. Doing this first will reduce emissions sooner and at a lower system cost than electrification alone.

Importantly, electrification of residential gas is much lower priority due to the impact on system cost. Increased residential electrification will increase demand on the grid, which is presently largely supplied by coal-fired generation in NSW. The choice to prioritise household electrification, and low ‘value’ CER, will have real consequences, both in cost to consumers and to the pace of Australia’s net zero transition.

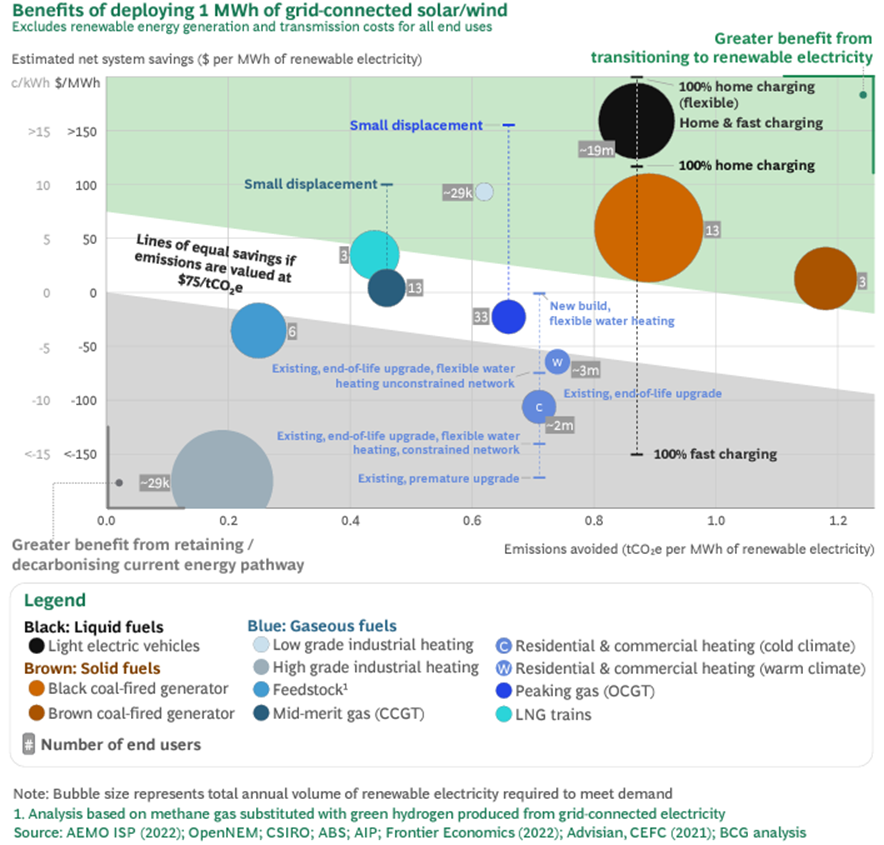

BCG’s analysis demonstrated the relative cost effectiveness of using renewable electricity or renewable gases to decarbonise different carbon intensive sectors (Figure 1). The white band is the range where renewable gas is cost comparative with renewable electricity. The importance of this overlap becomes apparent when used to determine a merit order, or ‘best bang for buck’ emissions reduction.

Figure 1: Grid-connected renewable electricity vs decarbonisation of current energy pathways

Source: BCG, 2023, The role of gas infrastructure in Australia’s energy transition

The best ‘value’ is achieved through phasing out coal-fired generation and liquid fuels used in light vehicles, and in electrifying low-grade industrial heating. For replacing end-of-life residential and commercial heating appliances and even more so for premature upgrades, much better ‘value’ is achieved through decarbonising the existing pathway.

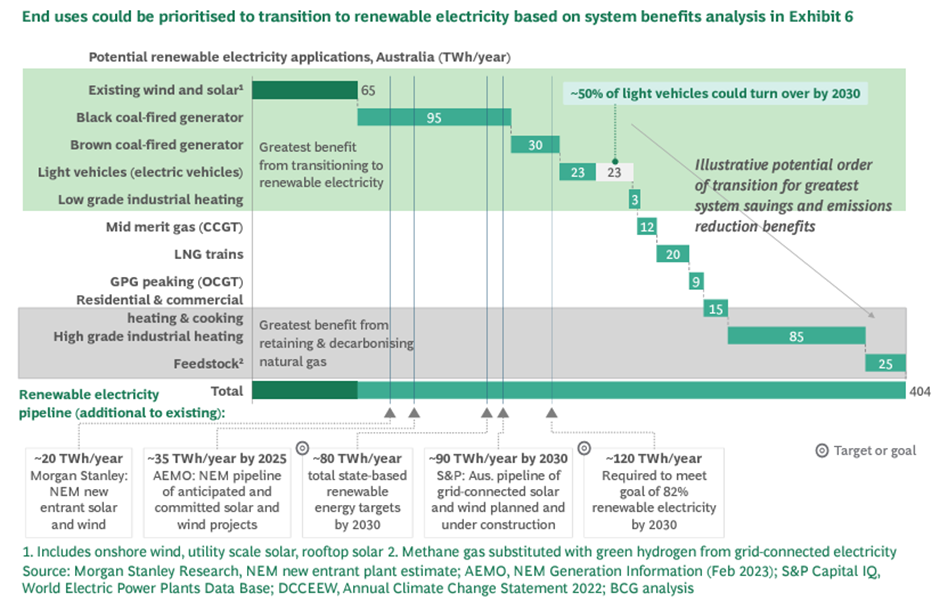

The analysis also showed (Figure 2) that the most cost-effective decarbonisation comes from applying the next 174 TWh of renewable electricity to decarbonisation of coal fired generation and light vehicle use, before decarbonising any other sector via renewable electricity. Furthermore, the next 166TWh of renewable electricity decarbonisation could be achieved through other forms of renewable energy for equal or lesser cost.

Figure 2: Decarbonisation by renewable electricity priority

Source: BCG, 2023, The role of gas infrastructure in Australia’s energy transition

Residential and commercial heating sits on the boundary of cost competitive and lower cost portions decarbonisation, relative to phasing out coal-fired generation and to investing in other CER such as electric vehicles. Instead of prioritising household electrification, pursuing parallel renewable electricity and renewable gas decarbonisation can double the pace of decarbonisation while reducing cost. This would allow renewable electricity to be used in its highest value applications: decarbonising coal fired generation and light vehicles.

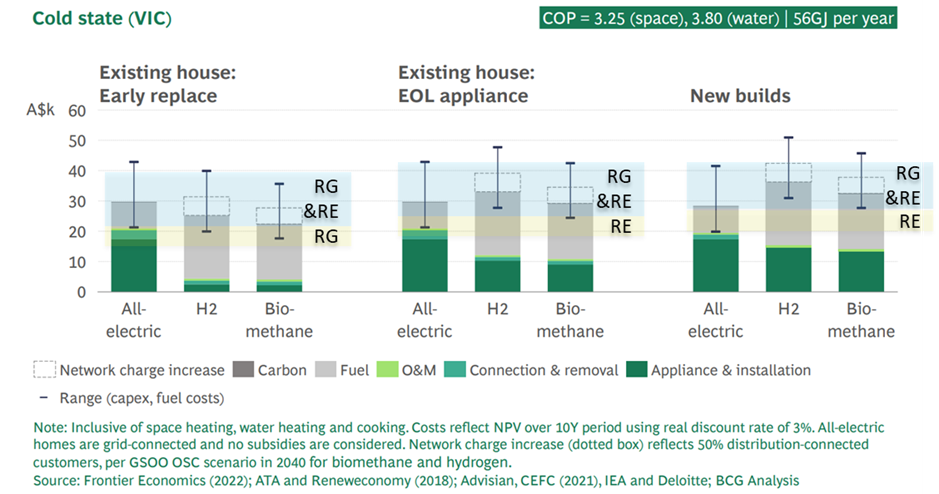

BCG’s research also demonstrated the cost competitiveness of renewable gas use in the home.[6] Renewable gases – green hydrogen and biomethane – by definition produce zero Scope 1 carbon dioxide emissions, and better than 99 per cent less carbon dioxide equivalent emissions than natural gas.[7] This means household customers have greater choice, opportunity, and capacity to decarbonise their household gas demand.

Figure 3 considers combined energy and appliance costs for household gas users in Victoria, which decarbonise through electrification, hydrogen or biomethane pathways. Each energy option includes a possible range of cost outcomes for different households considering the range of different potential appliance costs, and the range of different potential energy costs.

Figure 3: Cost comparison for electricity, green hydrogen and biomethane for residential users in 2040, at different points of appliance replacement with cost competitiveness ranges

Source: BCG, 2023, The role of gas infrastructure in Australia’s energy transition with APGA cost competitive range analysis

Overlapping combined cost ranges for all-electric, hydrogen and biomethane options indicates that there is a range of household gas customers for which renewable gas and renewable electricity both pose cost competitive gas use decarbonisation options. Further, this indicates that there is a range of household gas customers for which renewable gas is a cheaper option than renewable electricity to decarbonise gas use in their home.

Renewable gas as an option creates more choice for household decarbonisation, and also helps address many of the challenges of 100 per cent household electrification.

APGA recommends that the NSW Government consider the implications of BCG’s analysis in designing the Consumer Energy Scheme. Beyond ‘best value’, there are additional issues of equity that must be addressed in any future consumer decarbonisation policy. APGA provides some commentary on this in answers to the consultation questions.

To discuss any of the above feedback further, please contact me on +61 422 057 856 or jmccollum@apga.org.au.

Yours sincerely,

JORDAN MCCOLLUM

National Policy Manager

Australian Pipelines and Gas Association

Answers to selected consultation questions

Objectives

- Are these the right objectives for a Household Energy Strategy?

- Is there anything missing from the draft objectives?

Objective 1 necessarily excludes gas consumers who also wish to increase their efficiency. It should also reflect that the energy transition must be undertaken in a way that recognises equity of access. Hence, APGA suggests reworking this objective: ‘Encouraging equitable deployment of energy efficiency, household generation and flexible demand and storage.’

APGA considers the remainder of these objectives to be appropriate.

Principles

- Are these the right principles for a Household Energy Strategy?

- Is there anything missing from the draft principles? Is there anything that should be removed and why?

The principle on equity and accessibility should be expanded. The current principle focuses on equity of income and geography in accessing energy products and services, and consideration should also be given to liability. Consumers who cannot afford to access CER will nevertheless be liable to pay for them through their energy bills and through their taxes, with that liability increasing through additional targets and subsidies.

This equity issue can also be extended to gas customers who cannot afford to electrify, are logistically unable to electrify, or simply do not wish to electrify. These consumers not only be required to pay for the electrification of other households, they will be asked to shoulder a greater burden of the cost of maintaining gas networks as other households electrify and exit the market. This outcome would be made worse by subsidies and targets which do not secure the right for these customers to access renewable gas alternatives to decarbonise their gas use.

Encouraging deployment

- What role do you see consumer energy resources playing in the energy system as it transitions to net zero emissions? Compare this role to consumer energy resources in commerce and industry, and to grid supplied energy.

Consumer energy resources are an important part of the energy transition. However, they are not the only option, and some CER have more ‘bang for buck’ decarbonisation than others. APGA considers that CER should be considered alongside gas use decarbonisation, where it is not an ‘either or’ option, and that the NSW Government should target its efforts in CER where it will make the most difference.

Analysis by the Boston Consulting Group in 2023[8] demonstrated that the best ‘bang for buck’ in decarbonisation was electrifying coal-fired generation, light vehicle use, and low-grade industrial heat. To that end, focusing CER deployment effort on electric vehicles (EVs) is likely to have more immediate decarbonisation benefits for the cost. BCG also identified household heat as often being cost competitive or lower cost to decarbonise via renewable gas uptake, indicating that this option should be secured for gas customers.

- What do you see as the key barriers for increasing uptake of consumer energy resources?

- Consider all types of consumer energy resources including energy efficiency, flexible demand, electrification, solar and storage.

Cost and availability are likely the largest barriers to uptake of CER. Solar and battery infrastructure, along with any necessary household electrical system upgrades. Subsidies and financing can address some, but not all, of the cost-related barriers.

EVs come with additional challenges for consumers, namely access to charging infrastructure if unable to charge at home. This is likely to increase as vehicle turnover results in greater uptake of EVs potentially constrains access to public charging infrastructure. Despite this, EV uptake still represents the vast majority of customer savings when dissecting analysis on savings achievable through electrification of the home.

- Should the uptake of consumer energy resources be encouraged by the NSW Government? Why or why not?

- If yes, what are the best ways to do this?

To the extent that the NSW Government should be pursing all decarbonisation pathways, APGA agrees that the Government should encourage the uptake of CER. However, it should do so in a way that prioritises equity, and does not hamper other decarbonisation pathways, such as renewable gases. The NSW Government should also seek to encourage deployment of renewable gas technology options alongside electric technology options.

It is important to consider that while it is still true that coal-fired generation supplies the majority of NSW’s energy needs, electrification of household gas use can result in an increase in emissions due to the emissions intensity of the grid. Therefore, priority applications should be pursued first and be the target for government incentives – of which residential heating, cooling and cooking is not. APGA recommends undertaking Marginal Abatement Cost analysis of options supported by government to guide government support towards the biggest bang for every government dollar spend on decarbonisation.

Targets

- Should the government set specific targets for household consumer energy products, technologies or services?

- What are the benefits, risks and other considerations in setting targets for consumer energy resources?

- What technologies may benefit from targets?

- How should the government set and monitor achievement of the targets?

Given the decarbonisation benefits of EVs, the NSW Government should prioritise targets or incentives for EV uptake and supporting the roll-out of charging infrastructure in a Consumer Energy Strategy.

However, the NSW Government should exercise caution in setting further targets without full consideration of the cost burden of those targets on sectors that cannot benefit from them. This includes consumers who cannot afford to upgrade to an EV vehicle or afford to invest in charging infrastructure. APGA recommends the NSW Government take heed of lessons learned through solar tariff schemes noting that many jurisdictions are moving towards solar soaking charges to address the cost of overgeneration of rooftop solar into the grid.

Incentives

- Should the NSW Government provide incentives to encourage uptake of consumer energy resources?

The Energy Security Safeguard Schemes provide existing platforms for extending energy-efficiency and demand-reduction incentives, however, APGA considers that these schemes should not preclude high-efficiency gas appliances[9] and applications for renewable gases in all sectors, including residential.

APGA proposes that the NSW Government heed feedback on the Victorian Government’s VEU program. As identified by St Vincent de Paul Society, VEU draws funding from all energy customers, including Victoria’s lowest income households, to fund electrification for those who can afford to electrify.[10] This policy design risks increasing cost of living on low-income households and substantial social licence issues for decarbonisation policy.

When considering incentives, technology-agnostic subsidies can also deliver more decarbonisation bang for every government dollar spent when funding upgrades of lower cost appliances. Appliances which can use biomethane or that are hydrogen ready cost much less than their electric alternatives. If NSW was to secure renewable gas supply for household customers, then NSW appliance subsidies could deliver greater decarbonisation bang for every government dollar spent when funding upgrades to lower cost gas and hydrogen appliances.

- How could the NSW Government make better use of the Energy Security Safeguard schemes to provide incentives for the uptake of consumer energy resources by households?

APGA has previously provided comments on one of the Energy Safeguard Schemes, the Renewable Fuels Scheme (RFS).[11] APGA also provided comments to a proposed expansion of the RFS, which may impose further cross-subsidisation of decarbonisation by gas users.[12]

The liability structure of the Renewable Fuels Scheme will ultimately result in residential gas customers paying for the decarbonisation of other sectors, and may hamper the uptake of renewable fuels including renewable gas.[13] Similarly, eligibility for the GreenPower gas certification scheme is restricted to commercial and industrial customers, which only prevents households from accessing decarbonisation through renewable gas uptake even if when this is cost effective for customers.

- What other types of initiatives should the NSW Government use to provide incentives for uptake of consumer energy resources (such as government programs for specific types of households or specific technologies, loan programs, etc)?

As above, initiatives should not preclude high-efficiency gas appliances, which can provide a decarbonisation option that is more accessible for many households. Initiatives should be technology-agnostic to the extent that both gas and electricity decarbonisation pathways are preserved as an option for consumers.

Improving access

- What are the main issues or barriers with household access to consumer energy resources?

See answer to Q4.

- How can the NSW Government best improve access to consumer energy resources for:

- Private renters

- Social housing residents

- Low-income households

- Apartment residents

- Embedded network residents

- Regional and rural households

- Any other vulnerable groups?

Low-income, social housing, apartment and rental households should not be excluded from the energy transition, and equity of access should be paramount. Where electrification is the only energy-efficient option, many of these consumers are currently excluded due to the high cost of solar and battery technologies even with the assistance of subsidies, incentives and loan schemes. Many buildings, particularly apartment buildings and large social housing developments, cannot be readily electrified. Renters generally have no power or incentive to upgrade their leased properties, and landlords similarly have little incentive to invest in upgrades.

At the same time, these residents are currently subsidising the cost of the investment in these technologies for households who can afford and can access electric appliance upgrades.

Any option chosen by the NSW Government should take these issues into account, and not restrict options to electrification which can be high cost or unrealistic for many developments. APGA recommends that any option is technology-agnostic, such that current gas customers are not restricted from upgrading to cheaper high-efficiency gas appliances, which can be decarbonised through renewable gas.

Low-income household access to consumer energy resources

- What are the best ways to improve access to consumer energy resources for low-income households?

- What is the role of the NSW Government in driving uptake for these households?

- How can the private sector, including the finance sector and community organisations, contribute to improving access?

See answer to Q13.

Social housing tenant access to consumer energy resources

- What is required to ensure that social housing providers can use consumer energy resources to reduce energy bills and make their housing more liveable for their tenants?

- What sources of additional investment or innovation could help increase the number of homes upgrades across NSW?

See answer to Q13.

Private renters

- What are your views on implementing minimum energy efficiency rental standards to activate uptake of consumer energy resources across the rental sector?

- What should the Government consider as part of the investigation?

- What, if any, transitional measures would be needed such as lead times, temporary financial incentives, information tools to assist landlords etc?

- Would you like to be consulted further as part of the investigation?

See answer to Q13.

Apartment residents

- How can the government help improve access to consumer energy resources for apartment residents?

- Should the government focus on common areas and facilities, or on access for individual residents, or both?

See answer to Q13.

[1] APGA, Climate Statement, available at: https://www.apga.org.au/apga-climate-statement

[2] APGA, 2020, Gas Vision 2050, https://www.energynetworks.com.au/resources/reports/2020-reports-and-publications/gas-vision-2050-delivering-a-clean-energy-future/

[3] Future Fuels CRC: https://www.futurefuelscrc.com/

[4] Baxendale R, 2023, ‘Victoria appliance subsidy plan a ‘poor tax’ says charity boss’, The Australian, 12 December 2023, https://www.theaustralian.com.au/nation/politics/victorias-appliance-subsidy-plan-a-poor-tax-says-charity-boss/news-story/64ddd67cb1c01dae5b86aecfe1d80eb4

[5] Boston Consulting Group, 2023, The role of gas infrastructure in Australia’s energy transition, https://39713956.fs1.hubspotusercontent-na1.net/hubfs/39713956/The-Role-of-Gas-Infrastrcuture-in-Australia-s-Energy-Transition.pdf

[6] BCG, 2023, The role of gas infrastructure in Australia’s energy transition.

[7] See the National Greenhouse and Energy Reporting (Measurement) Determination 2008, https://www.legislation.gov.au/Details/F2023C00815

[8] Boston Consulting Group, 2023, The role of gas infrastructure in Australia’s energy transition, https://39713956.fs1.hubspotusercontent-na1.net/hubfs/39713956/The-Role-of-Gas-Infrastrcuture-in-Australia-s-Energy-Transition.pdf

[9] APGA, 2023, Submission: National Energy Performance Strategy, https://apga.org.au/submissions/national-energy-performance-strategy

[10] Baxendale R, 2023, ‘Victoria appliance subsidy plan a ‘poor tax’ says charity boss’, The Australian, 12 December 2023, https://www.theaustralian.com.au/nation/politics/victorias-appliance-subsidy-plan-a-poor-tax-says-charity-boss/news-story/64ddd67cb1c01dae5b86aecfe1d80eb4

[11] APGA, 2024, Submission: Renewable Fuels Scheme Rule 1 Consultation, https://apga.org.au/submissions/renewable-fuels-scheme-rule-1-consultation

[12] APGA, 2023, Submission: Renewable Fuels Scheme Expansion, https://apga.org.au/submissions/nsw-renewable-fuels-scheme-expansion

[13] APGA, 2024, Submission: Renewable Fuels Scheme Rule 1 Consultation, https://apga.org.au/submissions/renewable-fuels-scheme-rule-1-consultation